BNDES Secures BRL 9.1 Billion from Asian Banks for Sustainable Investments in Brazil

|

Listen to this story:

|

Agreements with China Development Bank and Asian Infrastructure Investment Bank aim at financing infrastructure and industry in Brazil

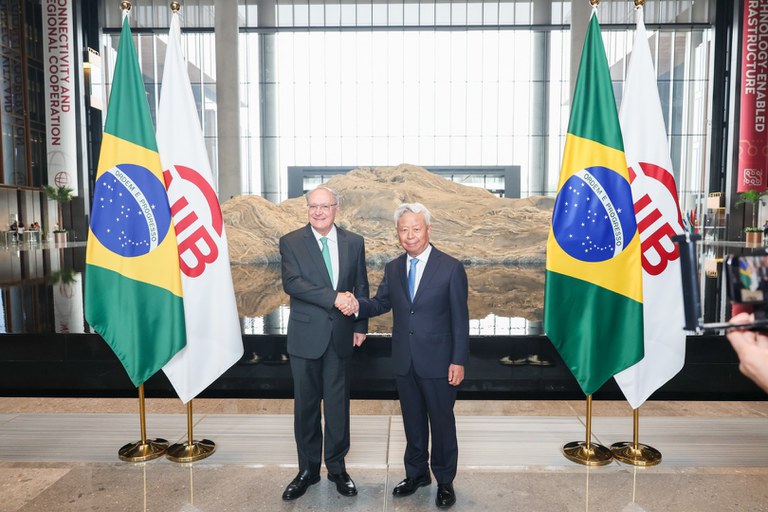

The Vice President and Minister of Development, Industry, Trade, and Services (MDIC), Geraldo Alckmin visited the Asian Infrastructure Investment Bank (AIIB) this Friday (June 7) in Beijing, heading a Brazilian international mission to China. He also participated in discussions on cooperation and climate financing and met with entrepreneurs.

On the occasion, the BNDES (Brazilian National Bank for Economic and Social Development) celebrated contracts and letters of intent with the China Development Bank (CDB) and the Asian Infrastructure Investment Bank (AIIB) totaling approximately BRL 9.1 billion (USD 1.7 billion) to finance sustainable projects.

Alckmin met with the AIIB President Jin Liqun, and both leaders committed to enhancing collaboration and partnerships, particularly to expedite and increase actions to counter climate change.

“Having access to funds such as those facilitated by AIIB is vital to address climate change“, stated Alckmin. “Wind and solar energy infrastructure used to be expensive. Now, they are the cheapest energy sources in Brazil. We must increase funding to make these solutions, which are currently costly, more viable and competitive, thereby aiding the planet,” highlighted the Brazilian Vice President.

“I wish to express our enthusiasm for a more comprehensive partnership between Brazil and AIIB. Much like the abundant renewable energy resources fueling Brazilian development, there is vast potential for growth between us. Brazil and the AIIB are aligned in this vision for sustainable development,” stated the president of the Chinese bank.

AGREEMENTS – BNDES and AIIB signed a letter of intent to facilitate deeper cooperation between them, with an investment potential of approximately USD 250 million (around BRL 1.3 billion) in areas such as renewable energies, logistics and sustainable urban mobility.

With the CDB, BNDES signed a ten-year loan, with a three-year grace period, of up to USD 800 million (approximately BRL 4.2 billion) to finance infrastructure and industrial projects in Brazil in electricity, manufacturing, agriculture, mining, water, climate change and green development. Additionally, the Brazilian bank signed a commitment with the CDB to evaluate short-term credit lines of up to RMB 5 billion (equivalent to BRL 3.6 billion or USD 670 million), with a three-year term to support investment actions by the Brazilian institution.

BNDES President Aloizio Mercadante also lauded the outcomes of the negotiations. “Brazil has reclaimed its role as a global leader under President Lula’s administration and is currently spearheading discussions on the significance of transitioning to a green economy. Through these partnerships with development institutions in China and Asia, we aim to propel even greater advancements in this domain.”

According to Nelson Barbosa, the Planning and Institutional Relations Director of BNDES, who represented the Brazilian institution in Beijing for the signing of documents, the partnership with AIIB is crucial for fostering knowledge exchange and expanding opportunities that will help Brazil and the world transition to greener economies. He also emphasized that “the partnership with the CDB strengthens BNDES’ financing capacity for projects that will benefit the Brazilian population.”

Infrastructure and support for Rio Grande do Sul

During a panel discussion involving representatives from both governments, AIIB, and private sector partners, the President of AIIB and Alckmin emphasized the significant alignment of Brazil’s vision and AIIB’s strategic emphasis on nature as infrastructure. They outlined plans in the medium term to increase AIIB funding and provide technical support for Brazil’s physical, social and digital infrastructure.

Related Article: Singapore’s Seraya Closes US$800 Million Asian Infrastructure Fund Backed by BlackRock and AIIB

Jin and Alckmin also witnessed the signing of a memorandum of agreement indicating AIIB’s intention to support Brazil’s recovery efforts following the floods that impacted the state of Rio Grande do Sul.