1PointFive, TD Announce One of the Finance Industry’s Largest Purchases of Direct Air Capture Carbon Removal Credits

|

Listen to this story:

|

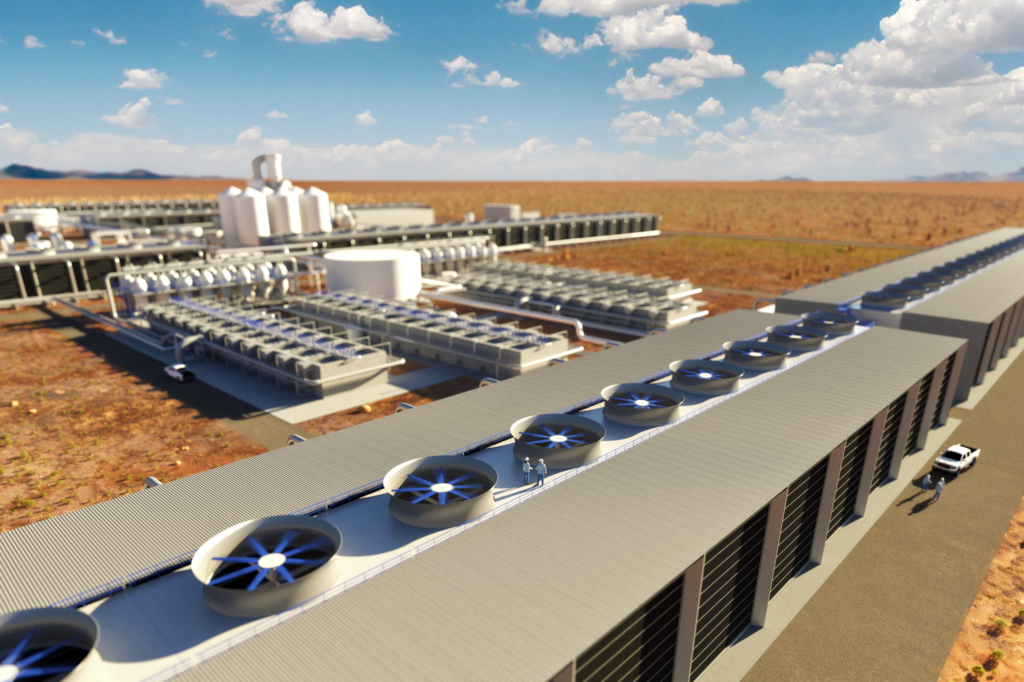

1PointFive, a carbon capture, utilization and sequestration company, and TD Bank Group (TD), announced a purchase of carbon dioxide removal (CDR) credits from STRATOS – 1PointFive’s first Direct Air Capture (DAC) plant currently under construction in Texas.

Under the terms of the agreement, and subject to STRATOS becoming operational, TD Securities has agreed to purchase 27,500 metric tons of Direct Air Capture Carbon Removal credits over four years. This represents one of the largest purchases of Direct Air Capture Carbon Removal credits by a financial institution and demonstrates TD’s continuing strategic focus on energy transition.

STRATOS has been designed to be the first large scale commercial deployment of DAC technology globally, with the potential to capture and remove up to 500,000 metric tons of CO2 from the atmosphere each year for secure and long-term storage in geologic formations. 1PointFive’s CDR credits are expected to provide a practical and high integrity solution for organizations to address their emissions.

With this transaction, TD Securities expects to add to its portfolio of voluntary carbon offsets, as it continues to build out its carbon advisory and trading capabilities in the voluntary and compliance carbon markets. These capabilities complement TD Securities’ broader ESG Solutions platform, with a focus on providing clients with short, medium and long-term solutions as they transition to a lower carbon economy. In addition, TD intends to use a portion of the credits from this transaction to offset its own operational emissions.

“As the need to move from climate commitments to action intensifies, corporations across all sectors are looking for tangible ways to achieve their net zero goals,” said Amy West, Global Head ESG Solutions, TD Securities. “We’re incredibly proud to partner with 1PointFive to support innovative, technology-based solutions that are intended to advance both our clients’ and our own decarbonization goals.”

1PointFive is progressing the development of Carbon Engineering’s Direct Air Capture technology, alongside other decarbonization solutions, at an industrial scale to help organizations achieve their net-zero goals. Under the agreement with TD Securities, the captured CO2 underlying the removal credits will be stored through geologic sequestration and not through an enhanced oil recovery process.

Related Article: Accenture, TD Bank Unveil Coalition With Disability:IN to Advance Disability Inclusion

“We are proud to partner with TD Securities and believe their purchase demonstrates how Direct Air Capture can become a vital tool in an organization’s sustainability strategy and help further net-zero goals,” said Michael Avery, President and General Manager, 1PointFive. “Carbon removal credits from Direct Air Capture will be measurable, transparent and durable, with the goal of providing a solution for organizations to address their emissions.”

“The transition to a low-carbon economy is complex, and relies on transformative action across sectors and economies, including the adoption of new technologies,” said Janice Farrell Jones, SVP, Sustainability and Corporate Citizenship, TD. “Direct Air Capture holds enormous promise as a tool to drive progress on this journey and we are proud to play a role, helping to scale innovation and support this growing business opportunity.”

In 2020, TD announced an ambitious Climate Action Plan to target net-zero greenhouse gas emissions associated with its operating and financing activities by 2050. TD’s carbon markets and sustainable finance activities include the following:

- TD has been listed on the Dow Jones Sustainability World Index for nine consecutive years and is currently the top-ranked North American-based bank on the World Index

- TD Securities is an active member of the International Emissions Trading Association (IETA)

- TD Securities established a Carbon Markets Advisory team, focused on the compliance and voluntary markets

- TD Securities invested $10 million in the Boreal Wildlands Carbon Project, the largest private land conservation effort in Canadian history

- In 2022, TD Securities joined Rubicon Carbon’s coalition of corporate sustainability lenders to help bring greater scale, confidence and innovation across all facets of the carbon market.

- Earlier this year, TD announced a new Sustainable & Decarbonization Finance Target that aims to mobilize $500 billion CAD by 2030 through financial activities including lending, financing, underwriting, advisory services, insurance, and TD’s own investments.