Singapore’s Sembcorp to Invest $10.5 Billion to Drive Global Energy Transition

|

Listen to this story:

|

- Accelerates renewables growth, targets 25GW of gross installed renewables capacity by 2028

- Strengthens commitment to decarbonisation, 50% reduction in emissions intensity by 2028

Sembcorp Industries (Sembcorp) announced its 2023-2028 strategic plan, reaffirming its commitment to transform its portfolio from brown to green and drive energy transition.

In 2021, Sembcorp unveiled its strategic plan to support the global energy transition and sustainable development. The Group has made significant progress, demonstrated robust execution capabilities and delivered strong results amidst a challenging macro environment. Gross renewables capacity has increased four-fold, to 12.0GW, and now comprises 61% of Sembcorp’s energy portfolio. Sembcorp has also achieved its 2025 GHG emissions intensity target ahead of time. Building on the strong momentum, Sembcorp is committed to the following targets for the next phase of growth.

Accelerate renewables growth

- Sembcorp is a leading renewables player in Asia and is on track to achieve its target of 10GW of gross installed renewables capacity by 2025. Sembcorp aims to grow its gross installed renewables capacity to 25GW by 2028.

Strengthen commitment to decarbonisation

- Sembcorp has achieved its 2025 emissions intensity target of 0.40 tCO2e/MWh (Scope 1 and 2). By 2028, Sembcorp aims to halve its emissions intensity to 0.15 tCO2e/MWh from 2023 forecasted levels of 0.30 tCO2e/MWh. The company is committed and on track to achieve its targets of reducing absolute emissions to 2.7 million tCO2e (Scope 1 and 2) by 2030, and net-zero emissions by 2050.

Related Article: Apple, Nike Launch Clean Energy Procurement Academy to Decarbonize Global Supply Chains

Continue to leverage gas as a transition fuel to fund renewables growth

- Sembcorp’s existing gas assets support Asia’s need for energy. The contracted gas portfolio provides cash flow visibility and will continue to contribute meaningfully through 2028. This cash flow will be used to fund the growth of Sembcorp’s Renewables segment.

Sembcorp will continue to actively manage its gas portfolio to support Asia’s shift to a clean and responsible energy future and to meet its carbon commitments. Sembcorp will invest in capabilities to position itself in low-carbon energy, low-carbon feedstock and carbon management. These include the production and consumption of hydrogen and its derivatives, in anticipation of its future commercial viability and technological maturity. By doing so, Sembcorp aims to fulfil the needs of its customers, while addressing critical concerns of energy security, accessibility and affordability.

Capital allocation – increasing renewables investments

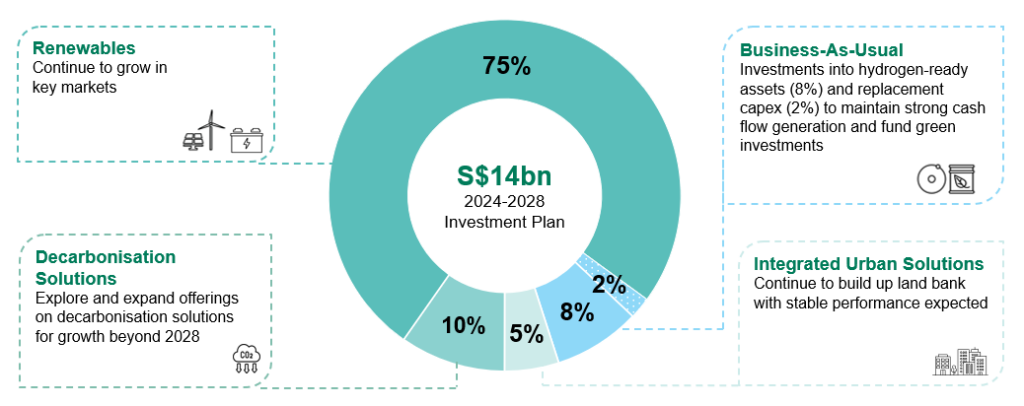

In line with Sembcorp’s strategic targets, a significant share of capital will be deployed to support renewables growth. Sembcorp will invest approximately S$10.5 billion, equivalent to 75% of 2024-2028 total investments, in renewables. 10% of capital will be deployed into investments including hydrogen-ready assets and a further 10% into decarbonisation solutions. The remaining 5% will be allocated to the Integrated Urban Solutions segment.

Wong Kim Yin, Group President & CEO of Sembcorp Industries: “Our vision is to be a leading renewable energy player in Asia, to drive energy transition and sustainable development. The 2023-2028 strategy provides a clear direction for Sembcorp for the next five years and we are well-positioned to capture tremendous opportunities in the key markets and create value for our stakeholders.”