Sustainable Investment Group IIGCC Releases Net Zero Alignment Guidance for Private Equity Investors

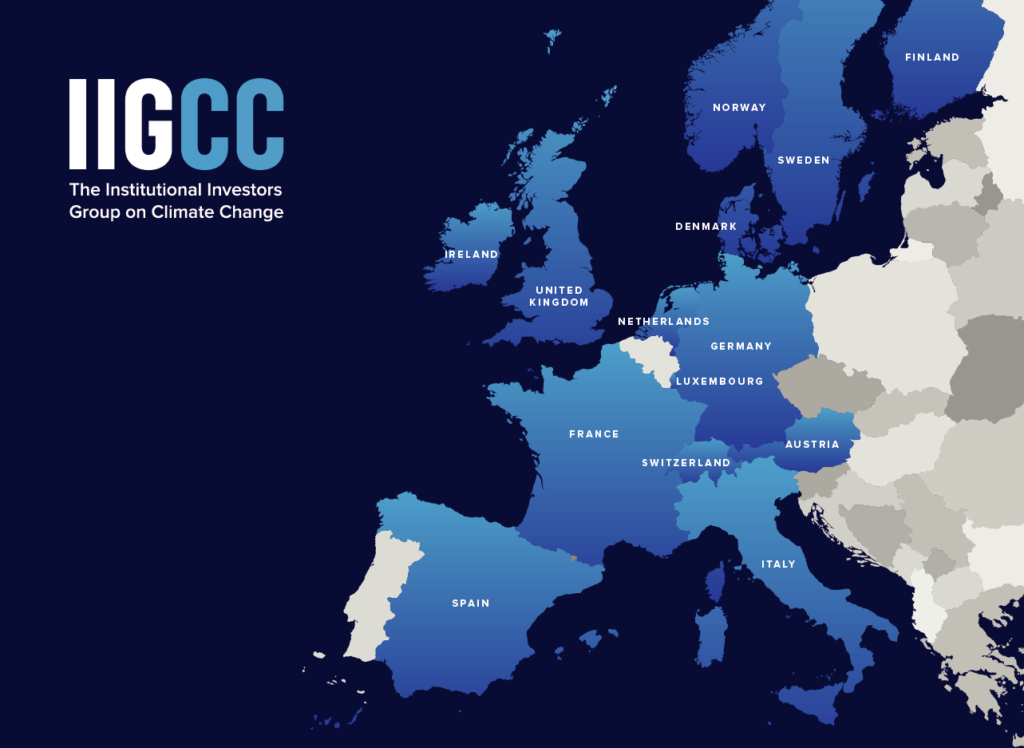

Sustainable investing-focused group the Institutional Investors Group on Climate Change (IIGCC) announced the publication of the first proposed guidance for private equity investors to align portfolios with net zero goals.

The IIGCC’s new guidance was published as a new component for the Paris Aligned Investment Initiative (PAII)’s Net Zero Investment Framework (NZIF). Launched in 2021, the NZIF provides asset managers with a common set of recommended actions, metrics and methodologies to maximize their contribution to achieving net zero emissions globally by 2050 or sooner.

According to the IIGCC, the new component provides most comprehensive private equity guidance currently available, relevant to both GPs and LPs. The guidance covers the scope of portfolio companies to be considered for measurement and management as part of a net zero strategy and metrics and targets to measure alignment over time, as well as implementation actions to achieve alignment targets and decarbonisation in the real economy.

See Related article here

Stephanie Pfeifer, CEO, IIGCC, said:

“This is an important step in bringing private markets – an ever-expanding and influential part of financial markets – in line with public markets. When it comes to net zero, private equity is currently a blind spot for institutional investors. We look forward to now seeing how many GPs adopt and are able to use the private equity components as a blueprint to make and implement net zero commitments.”

The launch of the new guidance expands the list of asset classes covered by the NZIF to five, including listed equity and corporate fixed income, sovereign bonds, real estate and private equity.

Pfeifer added:

“Ultimately, the more asset classes that can be incorporated into net zero analysis and strategy, the better chance asset owners and managers have of delivering real-world impact. We will therefore look to add more asset classes to the Net Zero Investment Framework this year.”

IIGCC stated that the proposed guidance is open for public consultation until February 27, with plans to publish the final component in Q2 2022.

Click here to access the consultation.