Tim Mohin: Top Five Takeaways from SEC Final Climate Rule

Two years after proposing the rule, more than 24,000 comment letters, and a nearly three-hour meeting marked by politically charged statements, the five Securities and Exchange Commissioners voted along party lines (3-2) to approve the final rule requiring climate-related disclosures for public companies listed on US stock exchanges.

Here is the TL/DR from the 886-page document with five key takeaways:

- Materiality rules: The SEC went back to basics by requiring companies to only disclose climate issues that are “financially material.” The definition of financial materiality has been debated for years and was determined by a Supreme Court ruling (TSC Industries v. Northway) as “a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote or make other investment decisions.”

There is one (big) exception for physical climate risks: Companies must disclose financial impacts greater than 1% of profits before taxes (specifically, companies must disclose capitalized costs, expenditures, charges, and losses incurred).

- Scope 3 emissions are out, but risks are still in play: Most of the coverage of the final rule has focused on exempting “Scope 3” emissions (value chain emissions) from disclosure. Although disclosure of Scope 3 emissions is not required, companies must disclose material climate risks and many of these risks occur in value chain activities (Scope 3). The SEC excluded reporting on laborious and uncertain Scope 3 emissions while keeping the focus on assessing material climate risks in the value chain (the SEC explains this point on page 91 of the final rule).

- TCFD backbone: The framework from the Task Force on Climate-related Financial Disclosures (TCFD) forms the backbone of the final rule. And, because the TCFD framework is also the common denominator in shaping other major climate standards (e.g., the EU and ISSB Standards), it is a helpful starting point for companies trying to “hit the easy button” to sort out all the new requirements.

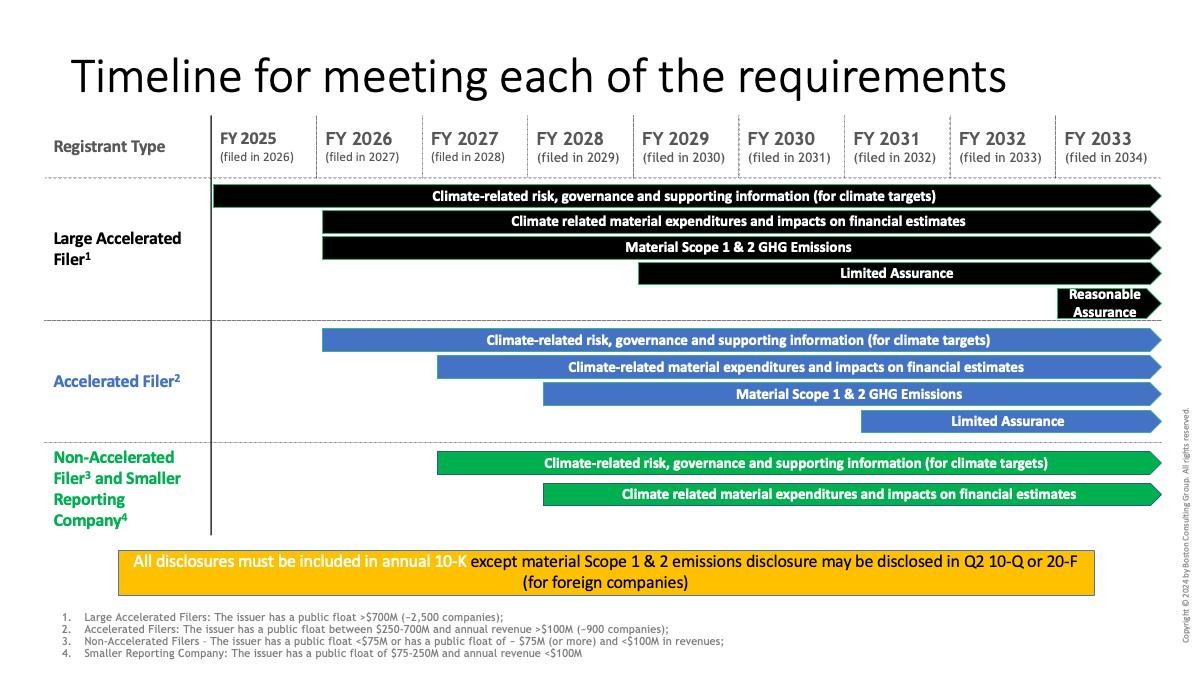

- Phased-in approach: Recognizing the costs and burden of disclosure, this final rule maintains a phased-in approach and exempts smaller companies from some requirements. The largest companies that are first to comply must collect information from FY2025 to be reported in FY2026. The phase-in and exemptions were also applied to assurance requirements. All of the disclosures must be made in the annual 10K filing with a notable exception: material scope 1 and 2 climate emissions can be disclosed in the company’s second-quarter 10Q filing – giving companies more time to collect and report this information.

In the graphic below, we took a crack at decoding the phase-in timeline in the SEC factsheet.

- Litigation delays and equivalency: As predicted, the ink wasn’t dry before the Attorneys General from ten conservative states filed a lawsuit to block the SEC’s final rule. There will be other suits filed in the coming days, and although the rule is supposed to go into effect in 60 days, the litigation will delay implementation.

In the meantime, companies must still grapple with a litany of similar requirements – for example, the Corporate Sustainability Reporting Directive (CSRD) from Europe, the new California climate laws, and various capital market listing rules (e.g., UK, Japan, Australia, Singapore, China, etc.). While the SEC did not provide much guidance on equivalency with other similar requirements, they did reference both the CSRD and California’s climate bills, how many companies will be covered by both the SEC rules and these other rules (~3,700 and ~2,520, respectively). They concluded that complying with these other rules would provide affected companies with systems and processes to comply with the SEC rule (pages 601-611).

SEC Climate Rule Fallout

The final rule took heat from all sides of the political spectrum. Some said the bill did not go far enough, like former commissioner Allison Herren Lee, who said, “Thanks to corporate lobbying, disclosure of the very real financial risks from climate change has fallen victim to the culture wars.” Democratic Commissioner Caroline Crenshaw said, “To be crystal clear, though, this is not the rule I would have written. While these are important steps forward, they are the bare minimum.”

RELATED ARTICLE: Tim Mohin: EU Reaches Peak Sustainability?

Others like Republican Commissioner Hester Peirce, who voted against the bill, believe the SEC is exceeding their remit, saying the rule “promises to spam investors with details about the commission’s pet topic of the day, climate.” Democratic Commissioner Jaime Lizárraga took the pragmatic middle, saying the Commission should not let “the perfect be the enemy of the good.”

Despite the main headline across most news sources being the extent to which the bill was weakened, both sides will still litigate. Republican state Attorneys General are already suing, and fossil fuel companies are likely to join them, arguing the SEC exceeded their authority. On the other side, the Sierra Club and others indicated they would take legal action alleging that the final rule did not go far enough.

As an editorial comment, the final rule strikes a healthy balance between giving investors decision-useful information, reducing the cost of compliance, and mitigating litigation risk.

SEC Chair Gary Gensler invoked President Franklin Roosevelt, who signed the law authorizing the Commission, saying, “Our federal securities laws lay out a basic bargain. Investors get to decide which risks they want to take so long as companies provide ‘complete and truthful disclosure.’” Gensler went on to note that most publicly traded companies are already issuing climate disclosures roughly aligned with the SEC rule.

The litigation over this rule will take time and, in all likelihood, will be decided in the US Supreme Court. The court recently heard a case that many think will result in overturning the “Chevron Deference” – which gives deference to the executive branch agencies to interpret law. In addition, the court has recently exercised its new “major questions” doctrine related to environmental matters by restricting the authority of the Environmental Protection Agency (EPA). Taken together, these cases paint a dim picture of this rule as the court challenges escalate.

This Smart Read article is contributed by Tim Mohin, Global Sustainability Leader, BCG. Every week ESG News delivers smart commentary from ESG practitioners and experts to unpack issues of the week. Submit your ESG Smart Read to editor@esgnews.com