Sweep Opens Denver Office to Expand U.S. Sustainability Data Services

- European ESG data platform Sweep opens first U.S. hub in Denver to meet rising demand for carbon and supply chain reporting tools.

- U.S. clients including Crocs, CH Robinson, and QCells already using Sweep to streamline compliance with emerging disclosure regimes.

- Expansion reflects growing convergence of European and American sustainability reporting frameworks, with nonfinancial data seen as a driver of profitability and resilience.

Denver chosen as North American hub

European sustainability data platform Sweep has opened its first U.S. office in Denver, Colorado, marking a significant expansion of its North American operations. The move positions the Paris-based company to serve a growing roster of American clients seeking to manage carbon and ESG data more efficiently amid tightening disclosure requirements.

Denver was selected for its central location, growing corporate ecosystem, and existing Sweep staff already embedded in the city. The office will anchor U.S. operations and support clients across sectors including manufacturing, logistics, energy, and finance.

Rising demand for ESG data management

Sweep has built its reputation in Europe by helping companies comply with complex disclosure frameworks such as the EU’s Corporate Sustainability Reporting Directive (CSRD). The company is now applying that expertise to U.S. firms that face intensifying demands for transparency from investors, regulators, and supply-chain partners.

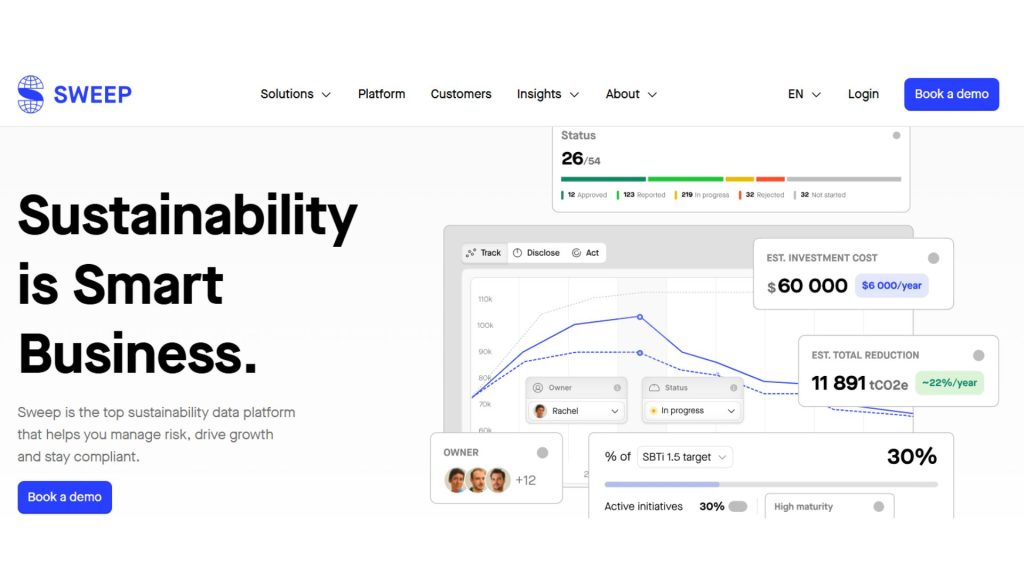

Its platform maps corporate carbon footprints, automates fragmented reporting processes, and supports transition planning. Clients including Crocs, CH Robinson, and solar manufacturer QCells already use Sweep’s tools to integrate sustainability data into business decisions.

Chief executive and co-founder Rachel Delacour said U.S. demand is growing as companies recognize that sustainability reporting can strengthen business performance as well as compliance. “Forward-thinking international companies understand that sustainability is a strategic lever, as are the valuable nonfinancial data that result from it,” she said. “The companies we work with are seeing the benefits, whether it’s reducing costs, better managing risks, or optimizing their business model, especially their supply chain.”

RELATED ARTICLE: Sustainability SaaS Platform Sweep Appoints Freddie House as Chief Revenue Officer

Beyond compliance: data as a profit driver

The company is positioning itself not simply as a compliance tool but as a business enabler. Sweep’s chief revenue officer and North America lead, Freddie House, stressed that nonfinancial data can drive resilience and profitability. “U.S. businesses see them as a strategic asset, and this is why we are seeing strong growth in this market,” he said. “Sweep is optimised to support businesses in all sectors to set the foundations today which will permit them to survive and thrive in the low-carbon economy of tomorrow.”

That pitch resonates with investors. Dr. Jeannette zu Fürstenberg, managing director at General Catalyst and founding partner of La Famiglia VC, noted that market appetite for digital ESG tools is accelerating. “The most forward-looking companies are already using this data as a strategic lever for resilience and competitiveness. Sweep is leading this transformation,” she said.

Convergence of U.S. and European frameworks

The expansion also reflects a growing overlap between European and American sustainability reporting standards. While Europe’s CSRD is setting the pace, U.S. regulators are tightening climate disclosure expectations, and large corporations are under pressure from global investors to harmonize practices across geographies.

For corporate leaders, the Denver launch illustrates how international expertise in ESG data management is migrating into the U.S. market. Multinationals operating across jurisdictions will be watching how quickly Sweep scales and whether its European playbook can adapt to the fragmented American regulatory landscape.

Implications for C-suite and investors

For boards and executives, the message is clear: nonfinancial data is no longer peripheral. It is becoming central to risk management, supply-chain resilience, and long-term profitability. Platforms like Sweep are positioning themselves as essential infrastructure in a world where climate and ESG disclosures are moving from optional to mandatory.

Investors, meanwhile, see opportunities in firms that can monetize the value of sustainability data rather than treat it solely as a compliance burden. As the U.S. market matures, competition among data management platforms will intensify, but Sweep’s early entry and European regulatory expertise could give it a first-mover advantage.

Follow ESG News on LinkedIn