McKinsey’s Global Energy Perspective 2025 Warns of Slower Transition Despite Renewables Growth

• McKinsey projects renewables could supply up to 67% of global power by 2050, but fossil fuels may still account for more than 40% of total energy use.

• Alternative fuels such as clean hydrogen are unlikely to achieve widespread adoption before 2040 unless mandated.

• Rising energy demand from data centers and affordability concerns could slow progress toward Paris Agreement targets.

A Transition Losing Momentum

McKinsey & Company’s Global Energy Perspective 2025 finds the world drifting toward a slower energy transition across all modeled scenarios, as policymakers balance decarbonization with affordability and security amid geopolitical uncertainty.

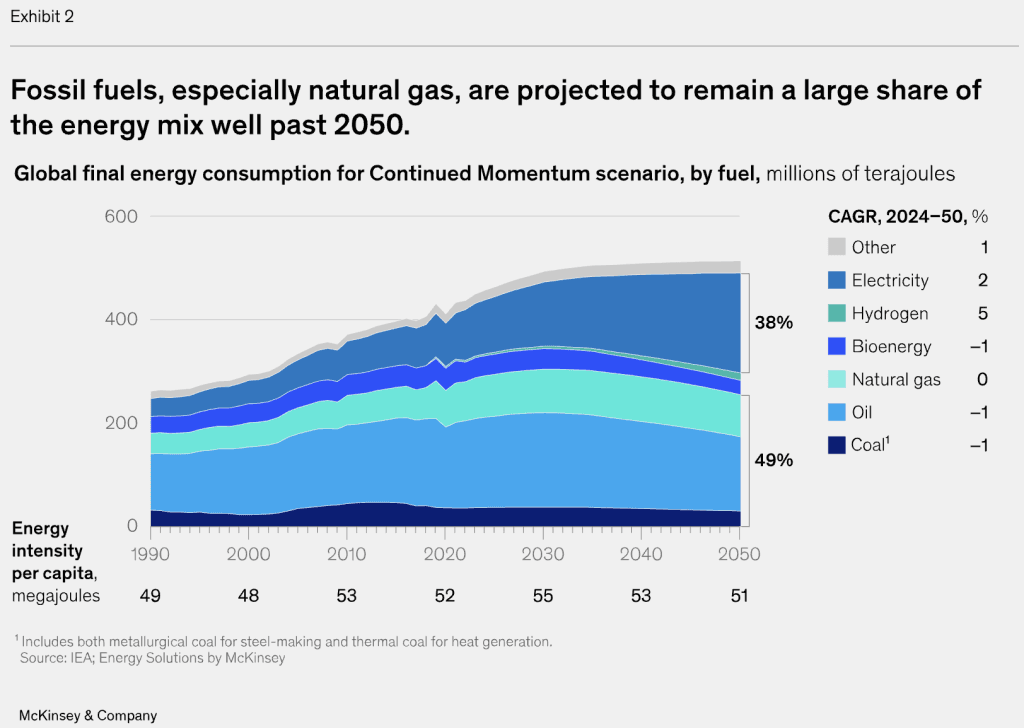

The report—McKinsey’s tenth annual outlook—forecasts that renewables could provide 61% to 67% of global electricity by 2050. Yet fossil fuels are projected to retain a 41% to 55% share of total energy consumption depending on the scenario.

“Ten years on from the inaugural Global Energy Perspective, our view of the energy transition has matured,” said Diego Hernandez Diaz, Partner at McKinsey. “The transition is no less urgent, but the pathways to closing the gap to Paris Agreement targets are now more complex.”

Three Scenarios, One Common Reality

The study models three possible trajectories: Slow Evolution, Continued Momentum, and Sustainable Transformation. All point to higher global warming projections than last year’s edition, signaling that the pace of decarbonization is decelerating.

Low-carbon power could exceed 65% of total generation by 2050 in the Continued Momentum case, while “clean, firm” energy sources such as geothermal, hydropower, and nuclear are expected to expand roughly 3% per year through mid-century.

However, clean hydrogen remains non-competitive at scale, limiting its role in the near term. The report also highlights that achieving the final 5% of power-sector decarbonization could cost between $90 and $170 per metric ton of CO₂, compared with just $20 per ton for earlier reductions.

RELATED ARTICLE: Climate Fund Managers Closes $1B Climate Adaptation Fund for Emerging Markets

Demand Growth from Data Centers

Electrification is driving global power demand upward, with data centers emerging as a key growth engine. Between 2022 and 2030, McKinsey projects data-center electricity use will grow 17% per year on average, particularly across OECD countries.

This rise underscores a widening gap between new demand centers and renewable supply growth, intensifying pressure on grids and investment timelines.

Regional Pathways Diverge

McKinsey stresses that there is no single route to net zero. Each country will follow distinct transition paths shaped by its economic conditions, resource base, and industrial priorities.

“The challenge for the industry and policymakers will be to ensure the energy system is affordable, reliable, and resilient to price spikes, outages, and geopolitical instability,” said Humayun Tai, Senior Partner at McKinsey. “The journey toward decarbonization remains long, but there is still considerable opportunity for energy stakeholders to act now and get back on track.”

Outlook

McKinsey’s Global Energy Perspective 2025 suggests the world’s energy transformation is advancing—but not at the pace required to meet Paris goals. Solar and wind capacity could expand threefold by 2030 and more than ninefold by 2050, but affordability and geopolitical constraints may continue to define the decade ahead.