Mozambique Receives $2M Drought Insurance Premium as AfDB’s Climate Risk Programme Reaches $150M

• Mozambique receives its third consecutive drought insurance payout under AfDB’s ADRiFi programme, covering the 2025–2026 agricultural season.

• The Africa Disaster Risk Financing Programme (ADRiFi) has now mobilized over $150 million across 16 African countries, protecting more than six million people.

• Jointly led by the African Development Bank and national governments, the programme integrates sovereign risk insurance into policy frameworks to strengthen resilience to climate shocks.

Building Resilience Through Financial Preparedness

Mozambique has received a $2 million insurance premium from the African Development Bank (AfDB) to safeguard against drought risks for the 2025–2026 agricultural season, strengthening its national preparedness amid intensifying climate impacts.

The financing was announced at the 2025 Climate and Disaster Risk Financing Forum, held in Maputo from October 14 to 16, under the theme “Building Africa’s Resilience through Transformative Climate and Disaster Risk Financing and Insurance.” The forum brought together senior officials from the Mozambican government, AfDB representatives, donors, and regional agencies to advance the Africa Disaster Risk Financing Programme (ADRiFi).

A Continental Mechanism for Climate Security

ADRiFi, launched by AfDB in 2018, is designed to build financial resilience across African nations by supporting sovereign risk insurance and embedding disaster risk financing into national policy and budgeting. The programme aims to help governments move from reactive crisis response toward anticipatory, data-driven climate risk management.

Through the initiative, AfDB provides direct financing and subsidized insurance premiums while enhancing technical capacity on risk modelling and fiscal planning. The African Risk Capacity (ARC) Group delivers the insurance coverage and rapid disbursement mechanisms once drought or flood thresholds are met. Funding for ADRiFi is channelled through a Multi-Donor Trust Fund supported by the United Kingdom, Switzerland, Canada, Norway, and the Netherlands.

Strengthening Africa’s Climate Insurance Framework

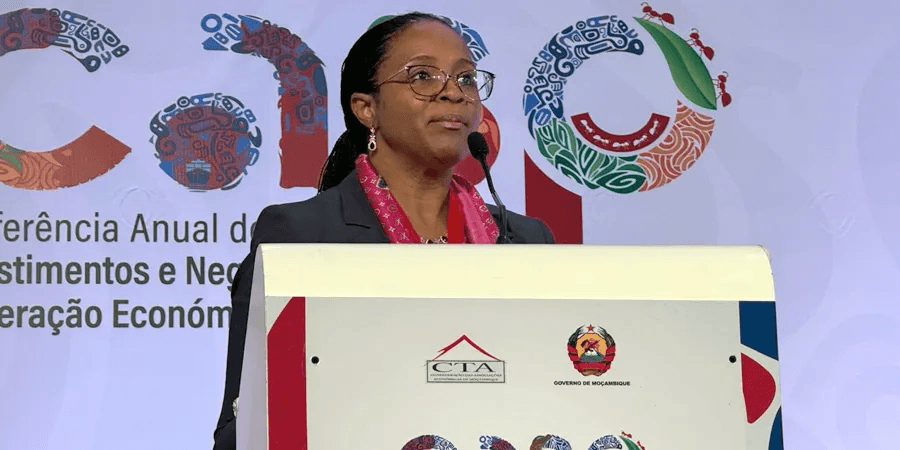

At the forum, Albertina Fruquia Fumane, Permanent Secretary at Mozambique’s Ministry of Finance, received a ceremonial cheque marking the country’s latest insurance premium. She described the coverage as “a strategic instrument of anticipation that enables the state to protect the most vulnerable, maintain social stability, and mitigate the economic impacts of recurring climate shocks.”

Andrew Mude, the AfDB’s Lead for De-Risking Agricultural Finance and Climate Resilience, said the programme’s expansion reflects the urgency of scaling preventive climate mechanisms. “Climate impacts are intensifying across Africa. ADRiFi has mobilized over $150 million in support of 16 African nations, safeguarding more than six million people and demonstrating the transformative potential of strategic financial solutions in protecting lives and livelihoods.”

Ambassador Elsbeth Akkerman of the Netherlands, representing ADRiFi’s donors, emphasized that African governments’ ownership of the initiative has been central to its effectiveness. “It is the African leadership that enables success,” she said, highlighting the role of ministries of finance as champions of the framework.

Field Impact and Policy Alignment

Forum delegates visited drought-affected communities in Magude District, Maputo Province, to see firsthand how insurance coverage enables early action and targeted relief. The visit demonstrated how payouts are used to deliver essential support, such as seeds, livestock feed, and social protection for households facing crop loss.

RELATED ARTICLE: Africa Advances Carbon Market Strategy to Drive Climate Finance

Gabriel Belem Monteiro, Vice-President of Mozambique’s National Institute for Disaster Risk Management and Reduction (INGD), called the forum “a strategic opportunity to strengthen capabilities, align policies, and consolidate African leadership in disaster risk management.”

Anthony Mothae Maruping, Chairperson of ARC’s Board, framed Mozambique’s continued participation as a blueprint for the region. “This sends a powerful message to the rest of the continent: when Africa leads with foresight and unity, Africa wins,” he said.

Claire Conan, Country Director of the World Food Programme in Mozambique, added that the continent’s future resilience hinges on early, evidence-based action. “Parametric insurance is more than a financial instrument—it’s a commitment to proactive action. Acting early, efficiently, and based on evidence is not just good practice—it is a moral and economic imperative.”

Implications for African Climate Governance

With losses from droughts, floods, and cyclones estimated to cost Africa $7–15 billion annually, expanding sovereign climate insurance coverage remains a central pillar of resilience strategies. The ADRiFi model—combining donor funding, multilateral coordination, and local execution—offers a replicable template for other developing regions facing similar systemic climate risks.

As Africa moves toward implementing the African Union’s Climate Change and Resilient Development Strategy (2022–2032), mechanisms like ADRiFi will play a pivotal role in bridging the continent’s protection gap. Mozambique’s sustained participation not only strengthens its fiscal preparedness but also contributes to a growing body of African-led financial innovations designed to anticipate, rather than absorb, climate shocks.

By integrating climate risk financing into national governance frameworks, the continent is laying the groundwork for more predictable, self-reliant responses to extreme weather—advancing both climate resilience and economic stability across Africa.

Follow ESG News on LinkedIn