Germany Pushes EU to Revisit 2035 Combustion Engine Ban as Industry Pressure Rises

• Germany asks the European Commission to allow exemptions to the 2035 phaseout of new combustion-engine vehicles, citing competitiveness and employment concerns.

• Berlin seeks flexibility for plug-in hybrids and highly efficient engines as Europe’s EV market faces slower demand and stronger Chinese competition.

• Industry groups welcome the move, while campaigners warn that regulatory dilution risks delaying the EU’s decarbonization trajectory.

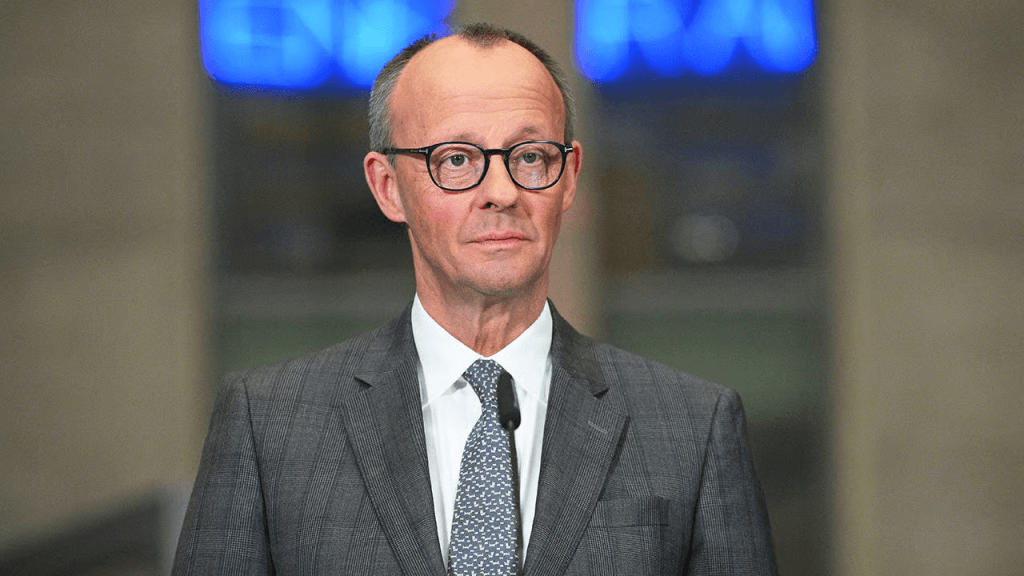

German Chancellor Friedrich Merz will ask the European Commission on Friday to ease the bloc’s planned 2035 ban on new combustion-engine cars, escalating a policy debate that sits at the centre of Europe’s industrial competitiveness and climate trajectory. Merz’s letter to Commission President Ursula von der Leyen argues that automakers need more room to navigate weaker-than-expected EV demand and surging competitive pressure from China.

Merz, a long-time ally of Germany’s car industry, said the current timeline for phasing out combustion engines is “unrealistic” given the sector’s market challenges. “We were all aware of the current situation in the automotive industry,” he said, calling it “precarious.” He added that Germany remains committed to its climate goals, but warned that decarbonisation must not come at the expense of industrial employment. “We want to achieve them with mobility that also preserves jobs in Europe and especially in the German automotive industry.”

Berlin Seeks Exemptions Ahead of New EU Targets

The move follows a split inside Germany’s coalition government, with the Social Democrats initially reluctant to revisit the EU deal. But after negotiations concluded on Thursday, the government agreed to seek exemptions covering plug-in hybrid vehicles as well as “highly efficient” combustion engines.

The intervention comes ahead of the Commission’s 10 December update to the EU’s carbon-emission targets for the automotive sector. That revision is expected to play a decisive role in shaping the investment strategies of major manufacturers and supply-chain partners for the next decade.

Automakers including Volkswagen, Mercedes and BMW have intensified lobbying for transitional pathways as EV uptake in Europe moderates. While companies have spent heavily to scale EV production, demand has undershot forecasts, squeezing margins and complicating planning for 2030–2035 product lines.

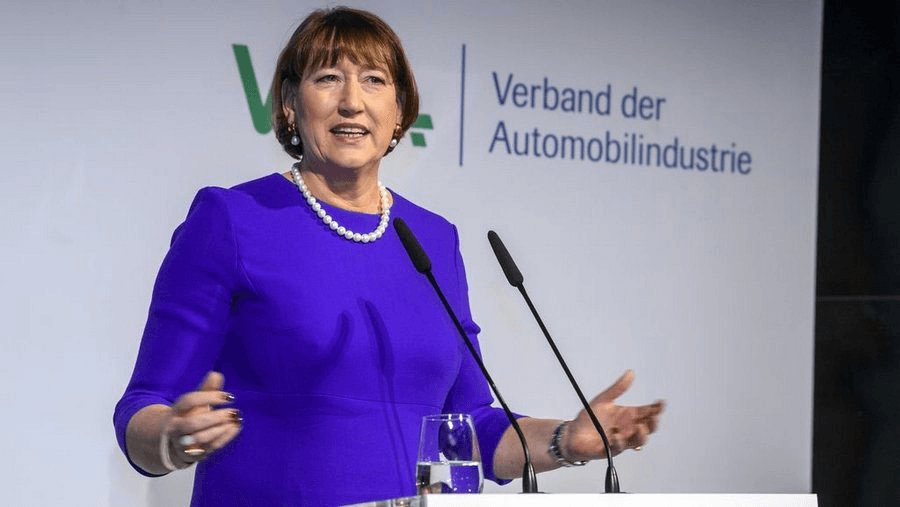

Industry Welcomes Flexibility; Workers Seen as Core Political Priority

Germany’s powerful automotive lobby, the VDA, welcomed Berlin’s call for adjustments. “This is good news for the automotive industry and its hundreds of thousands of employees,” said VDA President Hildegard Mueller. The group argues that a managed transition that supports hybrid technologies could help stabilise production, protect jobs, and maintain Europe’s technological relevance while EV adoption accelerates.

In a parallel effort to maintain momentum behind electrification, the coalition also agreed to launch subsidies targeted at low- and middle-income households for purchasing or leasing electric or plug-in hybrid vehicles. The announcement is intended to counter criticism that Germany is backsliding on climate ambition.

RELATED ARTICLE: Germany Launches $7B Industrial Decarbonization Program Integrating CCS

Environmental Groups Warn of Delays and Technological Lock-In

Campaign group Transport & Environment (T&E) sharply criticised the government’s stance, saying that any attempt to prolong combustion-engine sales jeopardises the EU’s long-term decarbonisation pathway. “Anyone who thinks that Germany will be able to secure jobs and value creation in the future with combustion-engine technology, which is already outdated today, is deliberately closing their eyes to reality,” said T&E Germany chief Sebastian Bock.

The group argues that Europe’s EV competitiveness challenge stems not from regulation but from limited corporate-fleet electrification. T&E pointed to fleet mandates as an alternative policy lever, saying that requiring large corporations to electrify 75% of new company cars by 2030 — coupled with made-in-EU criteria — could add 1.2 million locally produced EVs by the end of the decade.

What C-Suite and Investors Should Watch

Merz’s intervention reopens a policy debate many in Brussels had considered settled. For C-suite leaders, the outcome will shape capital allocation, platform development, and long-horizon hiring plans across Europe’s automotive supply chain. The request also intensifies inter-state negotiations, with several EU members insisting the bloc stay on course for full electrification by 2035.

For investors, the immediate question is whether flexibility now reduces transition risk or delays regulatory certainty. A partial exemption for hybrids could buy time for incumbent manufacturers but may also complicate EU taxonomy alignment, national subsidy schemes, and future emissions-trading interactions.

As the Commission prepares to release updated targets on 10 December, the debate cuts to Europe’s broader strategic quandary: how to defend industrial competitiveness while accelerating decarbonization. The decision will influence not just Germany’s automotive leadership but the EU’s position in a global market where climate policy, labour protection, and geopolitical competition increasingly collide.

Follow ESG News on LinkedIn