KKR Invests $603 Million In HMC Energy Transition Platform To Scale Grid Storage In Australia

- KKR to invest up to A$600 million ($603 million) into HMC Capital’s energy transition platform, backing a 652MW operational portfolio and 5.7GW development pipeline

- Capital targets battery storage and wind assets critical to grid stability as Australia accelerates renewable expansion

- Deal highlights rising institutional appetite for flexible infrastructure tied to AI-driven electricity demand and net zero targets

Global Capital Targets Australia’s Grid Flexibility Challenge

KKR has agreed to invest up to A$600 million ($603 million) into HMC Capital’s Energy Transition Platform, deepening institutional backing for battery storage and wind projects as Australia’s electricity system faces growing pressure from renewables growth and rising power demand.

The strategic partnership introduces KKR-managed funds as a long-term investor alongside HMC in a portfolio that already includes 652MW of operational assets and a 5.7GW pipeline of battery energy storage systems and wind developments. The transaction is expected to close in mid-2026, subject to regulatory approvals.

The investment arrives at a decisive moment for Australia’s power market. As coal generation retires and renewable penetration rises, the country’s policy agenda has shifted toward flexible infrastructure capable of balancing supply volatility and maintaining grid reliability.

Institutional Capital Targets Storage And System Reliability

KKR will fund the transaction through its Global Climate Transition strategy, which has committed more than $44 billion to climate and environmental sustainability investments since 2010. The firm has steadily expanded its exposure to energy transition infrastructure, and this deal marks its second climate investment in Australia after backing distributed energy platform CleanPeak.

Neil Arora, Partner and Head of KKR’s Climate Transition strategy for Asia, said, “As renewable generation in Australia continues to expand, the country’s energy system is at a pivotal moment. Delivering Australia’s ambition will require investment in flexible infrastructure such as battery storage to keep the grid secure and reliable. We are pleased to support HMC Capital’s leading operating platform, and by leveraging KKR’s global network, operational expertise, and deep experience across our climate, energy and infrastructure teams, we are well positioned to scale this platform and contribute meaningfully to Australia’s decarbonization objectives.”

For investors, the partnership highlights a shift toward assets that provide dispatchable flexibility rather than pure generation capacity. Battery storage, in particular, is becoming central to investment strategies as grids adapt to variable wind and solar output.

RELATED ARTICLE: KKR Acquires Dawsongroup to Drive Growth and Support Fleet Decarbonization

Scaling A National Renewable Platform

HMC Capital views the partnership as validation of its strategy to build a large-scale clean energy platform capable of supplying future electricity demand from households, industry and emerging AI workloads.

HMC Capital Managing Director and CEO David Di Pilla said, “We are delighted to be working with an experienced global investor of KKR’s calibre. KKR’s investment validates the quality of the Platform we have built and sets the foundation for HMC to play a major role in Australia’s transition to net zero carbon by 2050. KKR’s capital will enable the Platform to materially grow operating capacity, cash flow and progress the strategically valuable development pipeline.”

The company expects the investment to accelerate development timelines across its battery and wind projects, which are increasingly seen as essential to meeting Australia’s federal decarbonization commitments.

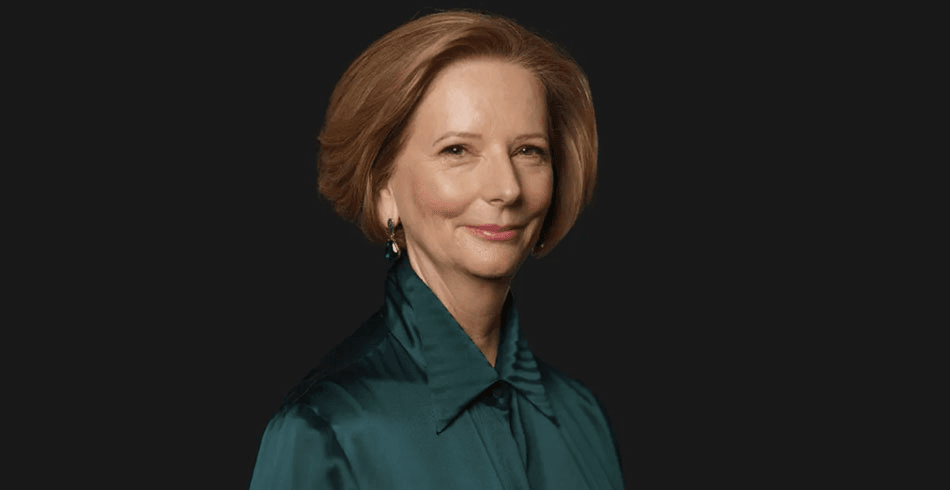

Julia Gillard, former Australian Prime Minister and Chair of the Energy Transition Platform, framed the partnership as a step toward building a nationally significant renewable operator. She said, “The introduction of KKR as a strategic partner marks a pivotal step in the Platform’s ambition to build a world class renewables business which can play a major role in helping Australia achieve its clean energy commitments. In KKR, we are delighted to have a collaborator with deep global relationships and expertise to help the Platform deliver on its goal to be a national champion of Australia’s transition to a net zero economy by 2050.”

Governance, Policy And Global Investment Trends

The deal reflects broader policy and governance dynamics shaping energy markets worldwide. Governments are prioritizing grid resilience as electrification accelerates across transport, industry and digital infrastructure. Institutional investors, meanwhile, are allocating capital toward assets that combine long-term contracted revenues with climate-aligned returns.

KKR’s global portfolio includes battery storage developer Zenobē in the UK, German energy services provider EGC, solar-plus-storage developer Avantus in the United States, and industrial decarbonization platform IGNIS P2X in Spain. Together, these investments illustrate a strategy focused on infrastructure that bridges policy mandates with commercial returns.

For executives and investors, the Australian partnership highlights a growing convergence between climate policy, infrastructure finance and energy security. As countries pursue net zero pathways, large-scale capital deployment into flexible generation and storage is emerging as one of the defining themes of the global energy transition.

Follow ESG News on LinkedIn