ADQ, Hanwha Finance Back ADFW 2025 as Abu Dhabi Expands Global Finance Reach

• Abu Dhabi Finance Week secures ADQ as Headline Partner and Hanwha Finance as Premier Partner, reinforcing state-driven ambitions to shape cross-border capital flows.

• The 2025 edition expands to more than 60 events and 300 sessions focused on AI finance, regulatory evolution, institutional partnerships and sustainable capital markets.

• Senior leaders from ADGM and Hanwha frame the partnership as a platform for Korea–UAE financial innovation, spanning digital finance, Web3 and broader capital market development.

Abu Dhabi Sets Stage for a Broader Global Finance Platform

Abu Dhabi is preparing to convene one of the largest financial gatherings in the region next year, bringing together sovereign funds, global banks, asset managers and digital-finance players under the 2025 theme, Engineering the Capital Network. The event will be held under the patronage of His Highness Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Executive Council.

This year’s partnership roster points to the Emirate’s ambition to sit closer to the centre of global capital allocation. ADQ returns as Headline Partner, maintaining its position as a strategic anchor for the event. The South Korean financial conglomerate Hanwha Finance joins for the first time as a Premier Partner, widening the geographic reach of ADFW’s institutional alliances.

The 2025 programme is the largest to date: more than 60 events, over 300 thematic sessions and around 750 speakers. The agenda places weight on the evolving mechanics of global finance, including AI-enabled models, regulatory change, shifts in sovereign and institutional capital flows, and the growing emphasis on both climate and inclusive financial systems.

Strategic Partnerships Reflect State Priorities

The depth of the partner network points to Abu Dhabi’s effort to consolidate its influence as a regional and global financial hub. Strategic partners include ADCB, Abu Dhabi Investment Office, the ADI Foundation, ADDED, Emirates NBD, First Abu Dhabi Bank, Mubadala, PGIM, SAAS Properties, UBS and Solmate. These institutions span sovereign investment, commercial banking, asset management and emerging-tech capital deployment.

Official partners reinforce that breadth. Abu Dhabi Securities Exchange joins alongside Binance, Capital.com, eToro, HSBC, Further Ventures, Hashed, Midnight, Phoenix, Presight and Standard Chartered. The mix of exchanges, banks, Web3 platforms and AI-driven data firms underscores the Emirate’s multi-sector approach to financial infrastructure building.

Salem Al Darei, CEO of ADGM Authority, framed the partnerships as central to the platform’s purpose. “We welcome our distinguished partners to ADFW 2025. ADFW has become the flagship platform for shaping the agenda of international finance, and the support of leading entities such as ADQ and Hanwha Finance strengthens our shared mission to advance innovation, deepen capital connectivity, and foster sustainable economic growth. Together, we look forward to delivering an exceptional edition that underscores Abu Dhabi’s position at the heart of the global financial landscape.”

Korea–UAE Capital Links Gain Prominence

Hanwha Finance’s participation adds a new dimension to the event, linking Abu Dhabi’s financial ambitions with those of one of Korea’s most globally active conglomerates. The partnership is positioned to strengthen bilateral cooperation across multiple capital-market segments.

RELATED ARTICLE: Abu Dhabi Finance Week (ADFW) 2024 Kicks Off Today

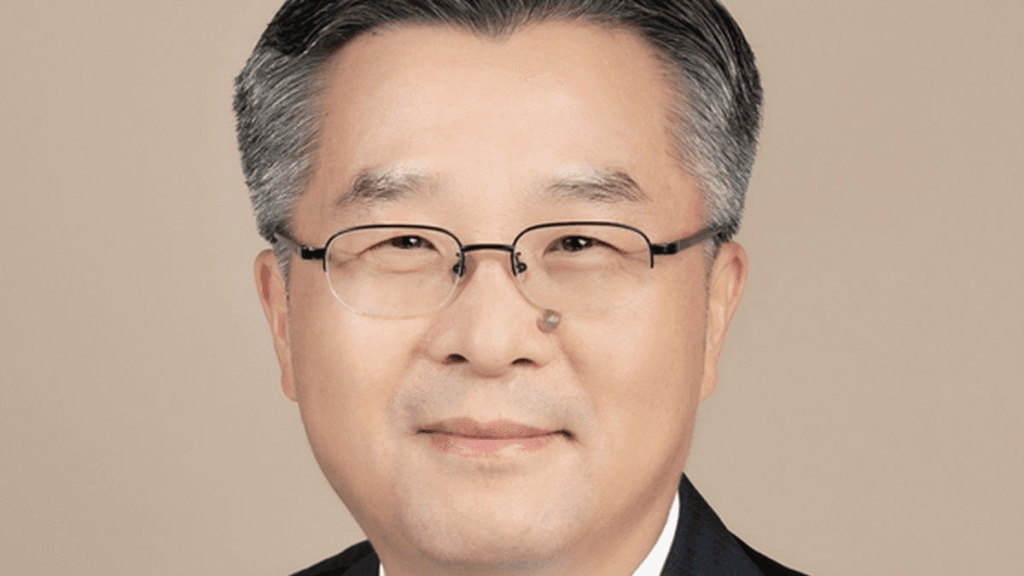

“This partnership celebrates a meaningful milestone for Hanwha Finance and the UAE in establishing collaboration across comprehensive financial sectors — expanding beyond digital finance, Web3, and wealth management,” said Hyeuk-woong Kwon, Vice Chairman and CEO of Hanwha Life under Hanwha Finance. He added, “Leveraging ADFW 2025 as a pivotal bridge, Hanwha Finance aims to take the lead in driving financial innovation in Korea and the UAE.”

The alignment suggests further convergence between Gulf sovereign strategies and Asian institutional investors, especially in areas such as AI-enabled financial services, advanced trading platforms and climate-linked investment frameworks.

Expanding the Influence Network

The event also draws major media and institutional partners whose participation often shapes policy-adjacent discussions across global finance. Bloomberg, CNBC, Abu Dhabi Chamber, Allianz Global Investors, BNY, Brevan Howard, CMB Monaco, Coinbase and the EU-GCC Cooperation on Green Transition Project join as Support Partners.

Etihad remains the official airline partner. ADGM Academy and NYU Stern return in knowledge-partner roles, a link that strengthens the event’s academic and technical foundations in finance, policy and regulatory science.

What Global Executives Should Track

For senior decision-makers, ADFW 2025 represents a concentrated view of where capital and policy debates may head in the next cycle:

• Gulf sovereign institutions continue to broaden their alliances, particularly with Asia’s financial conglomerates.

• AI-driven finance, market infrastructure and regulatory modernization remain top of the agenda for policymakers and institutional investors.

• Climate and inclusive-finance frameworks are no longer peripheral topics; they are increasingly core to capital-market design, especially across the Middle East and Asia.

A Regional Platform With Global Consequences

As Abu Dhabi expands its role in shaping financial connectivity, ADFW is becoming a barometer for wider shifts in investment governance, technology integration and sustainable-finance architecture. The partnerships announced for 2025 reflect a landscape where sovereign funds, commercial banks, digital-asset firms and global asset managers are aligning around new models of cross-border capital formation.

For global executives, the event’s growth offers not just a regional snapshot but a view into how emerging financial hubs are influencing regulation, investment flows and climate-aligned capital at a global scale.

Follow ESG News on LinkedIn