ESG India

The LEGO Group is widening its carbon removal portfolio with an additional DKK 18 million ($2.6 million) investment across four projects, deepening its engagement with both nature based and engineered...

A Market Design Moves Into Operation The UN carbon market established under the Paris Agreement has approved its first issuance of credits, formally shifting the long-negotiated Article 6.4 mechanism from...

Istanbul Anchors Cross-Border Sustainable Finance Push Garanti BBVA has extended €13 million, equivalent to approximately $14.1 million, to UNO, one of Türkiye’s leading bread manufacturers, to modernize its production infrastructure...

Schneider Electric has closed its five year Schneider Sustainability Impact 2021–2025 program with an overall score of 8.86 out of 10, capping a cycle that embedded climate, social and governance...

Brussels is considering legislation that could reshape Europe’s electric vehicle transition by targeting one of the market’s most influential buyers: large corporate fleets. New analysis from Transport & Environment (T&E)...

Ireland has unveiled a national plan to shift its economy away from the traditional take make waste model, positioning circularity as a core pillar of climate policy, industrial competitiveness and...

The Net Zero Asset Managers (NZAM) initiative relaunched Wednesday with more than 250 signatories, marking the return of one of the world’s most influential climate finance alliances after a year...

Deutsche Telekom has reached climate neutrality across its own operations worldwide, becoming the first company in Germany’s D ax 40 index to achieve net zero emissions for Scope 1 and...

A Strategic Bet on Distributed Energy DWS, the asset management arm of Deutsche Bank, has acquired Portuguese renewable energy community platform Cleanwatts in a transaction backed by a €150 million...

BBVA mobilized €134 billion ($145 Billion) in sustainable business in 2025, a 44 percent increase from the prior year and the highest annual figure in the bank’s history. The acceleration...

Mars, Incorporated has signed a long-term renewable electricity agreement securing the majority output of the newly commissioned Kölvallen Wind Farm in Sweden, marking one of the company’s largest clean energy...

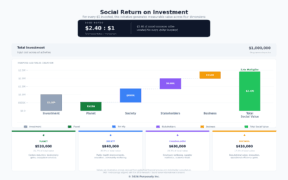

In the next phase of ESG, the advantage is shifting from who tells the best sustainability story to who can prove outcomes with decision-grade evidence. Purposefy has published a new...

Global Food Security Meets Climate Risk The National Geographic Society and PepsiCo have awarded five new research grants to scientists conducting on farm trials designed to strengthen soil resilience and...

The Hashgraph Group, a Swiss based Web3 and AI technology engineering firm within the Hedera ecosystem, has launched TrackTrace, an enterprise platform designed to help companies comply with the European...

Spain’s regional government has awarded ACCIONA the contract to develop and operate what will become the largest public EV charging hub within Madrid’s M-30 ring road, placing high capacity electric...

Mitsui & Co. Project Solutions have signed a long term virtual power purchase agreement with NIKE Japan Group to supply renewable energy attributes generated from domestic solar power projects. The...

European Union member states have given final approval to scale back landmark corporate sustainability rules, narrowing the scope of supply chain due diligence and reporting obligations after sustained pressure from...

ENGIE has completed and received regulatory approval for the Assú Sol photovoltaic complex, its largest operational solar facility worldwide, marking a major addition to Brazil’s renewable energy capacity. Located in...

Google.org is launching a $30 million Impact Challenge focused on AI for Science, aimed at accelerating breakthroughs in human health and climate systems. The global open call seeks to equip...

First Abu Dhabi Bank Misr (FABMISR) has launched the “Green Schools for a Sustainable Future” initiative, a public school sustainability pilot developed with Egypt’s Ministry of Education and Technical Education...