Moody’s Launches New ESG Insurance Underwriting Solution for P&C Insurers

- Solution will help (re)insurers operationalize the way they measure ESG risk at point of underwriting

- “The (re)insurance industry has a pivotal role to play in helping corporates make the transition to become more sustainable.”

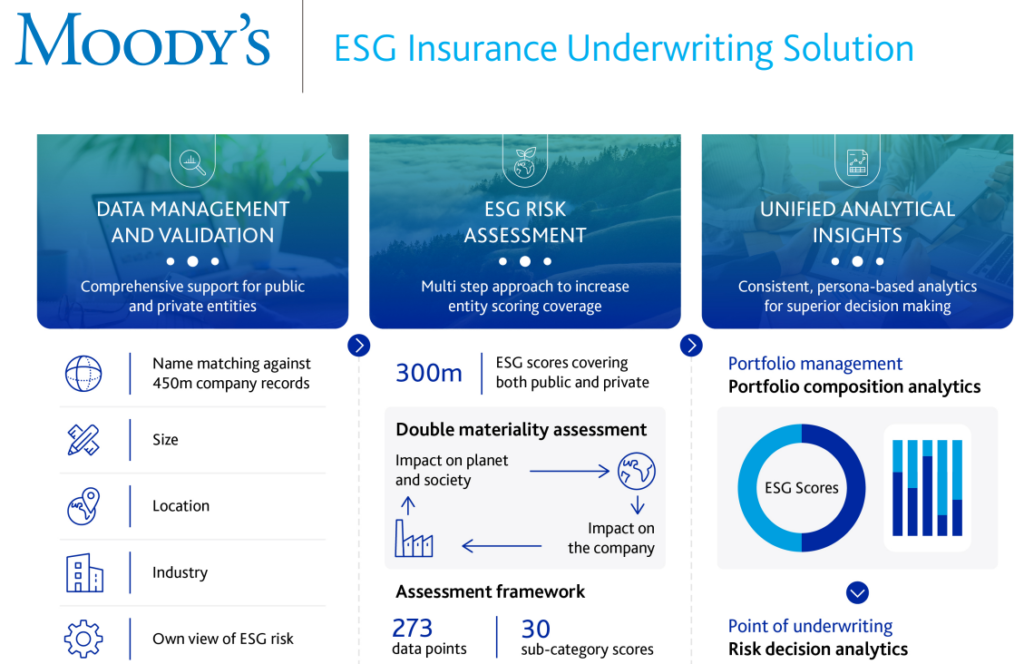

Moody’s launched its new ESG Insurance Underwriting Solution for P&C insurers, enabling customers to integrate ESG factors into commercial underwriting and portfolio management activities. The solution was born out of a collaboration with global specialty (re)insurer, Chaucer Group, combining their expertise in underwriting with Moody’s ESG and wider integrated risk modeling capabilities, which have been enhanced with the acquisition of RMS in 2021.

“As insurers are seeking to measure the ESG impact of their portfolio, alongside the assessment of traditional insurance risks, this new offering is a great example of how our integrated risk-assessment strategy helps meet our customers’ needs,” said Colin Holmes, General Manager of Insurance at Moody’s Analytics.

Mike Steel, General Manager of RMS, a Moody’s Analytics company, added: “We designed Moody’s ESG Insurance Underwriting Solution, with the support of Chaucer Group, to help (re)insurers operationalize the way they measure ESG risk at the point of underwriting. We can do so through the combination of data, technology and industry knowledge that we now have at our disposal following the Moody’s acquisition. By bringing these capabilities together, we are helping underwriters and portfolio managers transform ESG data into new insights on ESG risks and opportunities.”

Moody’s new solution uniquely combines data on public and private companies with a flexible and transparent ESG assessment framework developed in collaboration with Chaucer, to generate ESG indicators and scores that allow insurers to build their own view of ESG risk. Analytics derived from these scores and indicators help insurers monitor performance and trends, benchmarked against companies’ own ESG targets. These ESG insights are then incorporated alongside other key decisioning factors ─ for example, identifying relationships between ESG factors and financial-risk metrics, such as claims frequency and loss ratios.

See related article: Moody’s Corporation to Present at the Barclays Business Services ESG Summit on June 6, 2022

“Chaucer has been a crucial development partner to help us reach this point,“ added Mr. Holmes. “We are delighted they have been able to leverage the capabilities of our ESG Insurance Underwriting Solution to create a first-of-its-kind ESG balanced scorecard to provide a transparent and authentic approach to ESG risk assessment.”

John Fowle, CEO, Chaucer Group, added: “Over the last 12 months we have collaborated with Moody’s to support them in the development of Moody’s ESG Insurance Underwriting Solution by providing expertise in underwriting and risk management. The (re)insurance industry has a pivotal role to play in helping corporates make the transition to become more sustainable. This isn’t going to happen overnight but by helping clients identify areas that are in need of improvement, we can help them implement incremental changes that will pay dividends in the long-term.”

Alongside Moody’s ESG Insurance Underwriting Solution, Moody’s climate risk solutions for insurers include the Moody’s Analytics Climate Pathway Scenario Service and the RMS Climate Change Models for climate risk analytics.

Source: Moody’s