BlackRock’s Global Infrastructure Partners to Invest $335M in Grasim’s Green Arm

• Global Infrastructure Partners, part of BlackRock, will invest up to USD 335 million in Aditya Birla Renewables Limited for a minority stake, valuing the platform at roughly USD 1.64 billion.

• The deal ranks among the largest primary private equity commitments into an Indian renewables platform, backing ABREN’s 4.3 GW portfolio and 10 GW growth ambition.

• The investment reflects strong international confidence in India’s energy transition as the country attempts to meet soaring demand while advancing decarbonization and energy-security goals.

Aditya Birla Renewables Limited, the green energy arm of Grasim Industries, has secured a commitment of up to INR 3,000 crore, roughly USD 335 million, from Global Infrastructure Partners, the infrastructure investing platform acquired by BlackRock. The investment combines an immediate INR 2,000 crore tranche and a further INR 1,000 crore green shoe option, placing an enterprise value near INR 14,600 crore on the business.

For India’s renewable power sector, the capital infusion stands out as one of the largest primary private equity investments into a single platform. It arrives at a time when the country is navigating surging electricity demand, grid constraints, and the pressure to scale low-carbon generation far beyond today’s capacity.

ABREN has grown rapidly in recent years, assembling a 4.3 GW portfolio that spans 10 states and includes solar, hybrid, floating solar and round-the-clock configurations. That breadth is increasingly important for corporates searching for reliable clean power amid rising sustainability commitments and intensifying scrutiny from both domestic regulators and global value chains.

Inside the Deal and Its Strategic Stakes

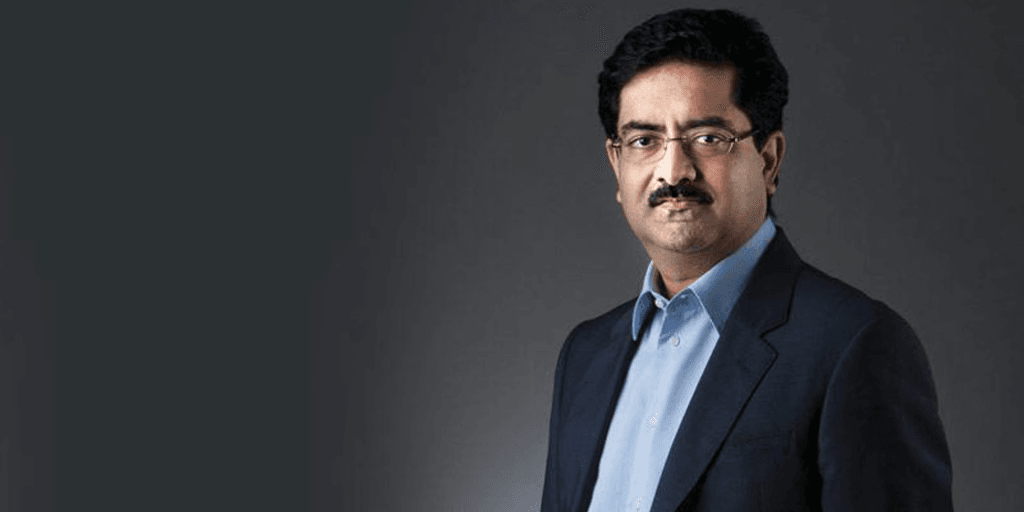

Aditya Birla Group Chairman Kumar Mangalam Birla framed the investment as a decisive step in positioning the Group for India’s next energy era. “India stands at the cusp of an energy transformation, arguably one of the largest anywhere in the world. The scale of the renewables opportunity in India is extraordinary, driven both by the urgent imperative of decarbonisation, and the sheer arithmetic of demand. This business sits squarely at the intersection of national energy security and climate leadership, two defining priorities for the coming decades,” he said.

Birla added that GIP’s entry strengthens the foundation for ABREN’s ambition to exceed 10 GW of capacity in the coming years. “GIP’s investment marks a pivotal moment in our growth journey, laying a strong foundation for an accelerated buildout of our renewables platform. Their global leadership in owning and operating some of the most sophisticated energy assets worldwide brings both rigour and reach to our ambition. At Aditya Birla Group, we see our renewables business emerging as a powerful growth engine for the Group, technologically advanced, capital-efficient and deeply aligned with the future India is building.”

For ABREN’s leadership, the partnership is about accelerating market positioning. Business Head Jayant Dua said the company is prepared to execute increasingly complex and large-scale projects. “ABREN is on an accelerated growth journey, and we look forward to this partnership with GIP as we build on our competitive positioning in the renewables sector in India. ABREN, backed by an experienced team, is well positioned to achieve its growth ambitions by executing complex, large-scale renewable projects. We aim to build a comprehensive renewables platform with a presence across all major technologies, focusing on both Commercial and Industrial segment and utility-scale projects.”

RELATED ARTICLE: BlackRock Launches Global Real Estate ESG ETF

Global Infrastructure Capital Aligns With India’s Decarbonization Push

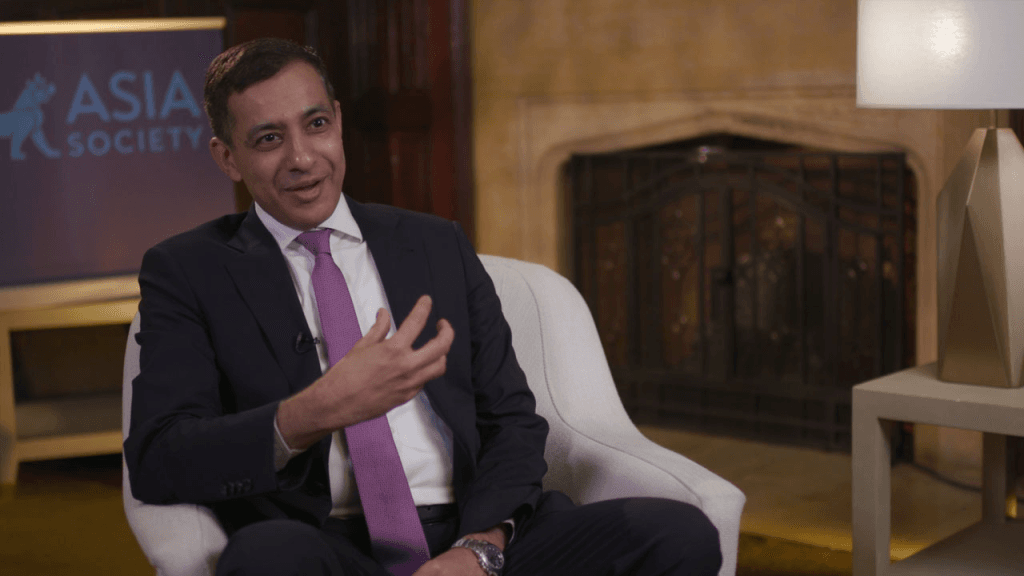

For GIP, the investment reflects its confidence in both India’s renewable market fundamentals and the long-term value creation tied to the energy transition. Raj Rao, GIP President and Chief Operating Officer, highlighted the strategic fit. “We are excited to partner with Aditya Birla Group, one of India’s leading conglomerates, as today’s announcement will allow us to continue to support innovation at scale. GIP’s experience in infrastructure across the globe, combined with Aditya Birla’s technical, operational and industrial capabilities, aims to develop Aditya Birla Renewables into a leading renewable platform that can contribute to the Indian industry’s decarbonization objective. Our investment reflects GIP’s confidence in India’s renewables sector and our commitment to advancing the energy transition in India.”

BlackRock’s acquisition of GIP earlier this year broadened the asset manager’s capacity to deploy long-duration capital into large-scale energy and infrastructure systems. The ABREN investment demonstrates how the combined platform is positioning itself across emerging markets where policy momentum, corporate demand, and national energy strategies overlap.

What Executives and Investors Should Watch

The partnership arrives as India accelerates deployment of renewable and hybrid solutions to stabilise the grid, expand industrial decarbonisation options, and attract global manufacturing supply chains. Corporate buyers, particularly in the commercial and industrial segments, are driving a wave of long-term clean power contracting that requires developers with balance-sheet strength and execution capability.

For global investors, the transaction reinforces a broader trend: India is becoming one of the most competitive destinations for private capital in the transition sector. A pipeline of multi-GW projects, improving state-level procurement structures, and strengthened policy clarity continue to draw institutional interest.

The deal is subject to statutory and regulatory approvals. Standard Chartered Bank served as sole financial adviser to ABREN.

As global renewable deployment pivots to markets where demand growth is steepest, transactions of this scale point to the expanding role India will play in shaping the economics and pace of the global transition.

Follow ESG News on LinkedIn