BriskFlow Launches OEM XBRL-ESG Reporting Integration Platform

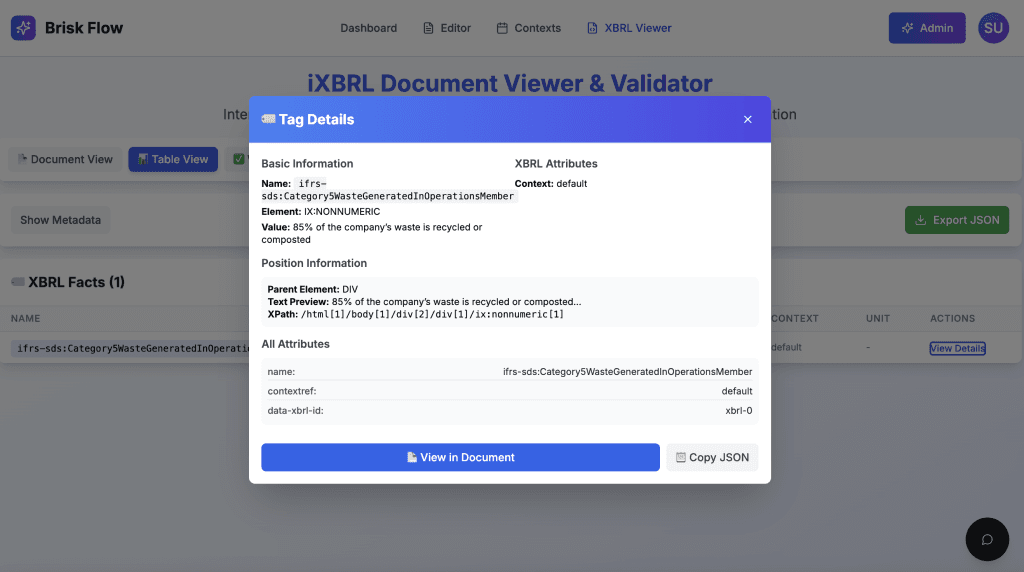

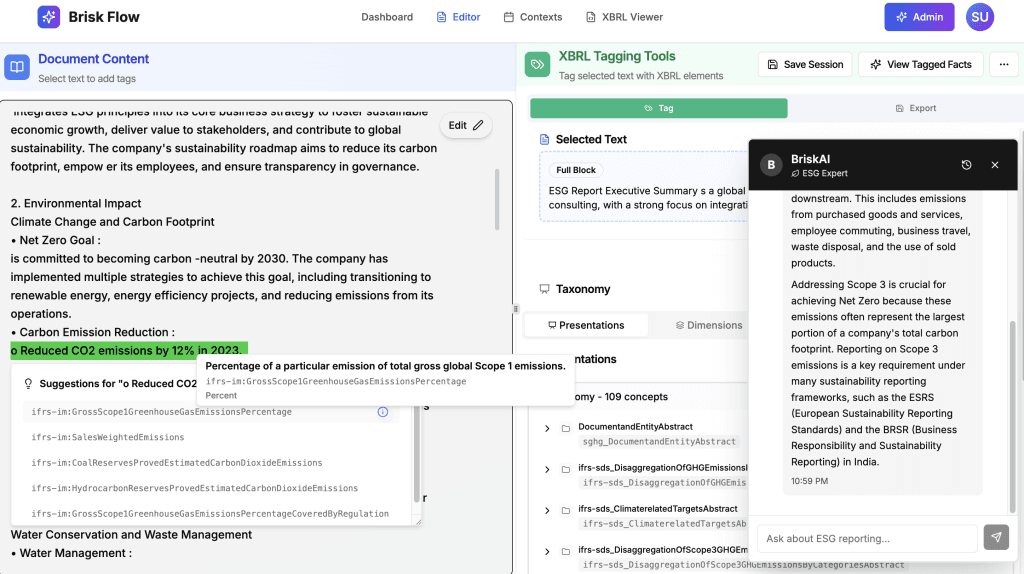

BriskFlow.ai has recently unveiled and launched a new XBRL-ESG integration feature to streamline ESG Reporting. The BriskFlow is a first-of-its-kind dedicated OEM (Original Equipment Manufacturer) layer for XBRL-ESG reporting. The platform is set to empower ESG reporting service providers to effortlessly API-integrate advanced XBRL and iXBRL tagging into their existing suites, transforming reporting from a chore into a strategic advantage. With native support for global standards including the EU’s CSRD, California’s SB-253, GRI, IFRS S1/S2, SASB, BRSR, SEC and ESEF taxonomies, BriskFlow enables providers to deliver machine-readable, auditable ESG reports without building from scratch – reducing integration time by up to 90% and enhancing their service offerings overnight.

As the CSRD starts rolling in and U.S. states like California back XBRL-tagged emissions data, the pressure for structured sustainability disclosures is intensifying. Legacy platforms often trap ESG data in silos, forcing manual tagging that delays filings and erodes data quality. BriskFlow‘s OEM layer flips the script: It acts as a lightweight, embeddable middleware that ingests unstructured inputs – PDFs, spreadsheets, or live feeds -and outputs fully tagged iXBRL files, ready for regulatory submission or investor analytics. This isn’t just compliance; it’s an AI-driven plug-and-play upgrade that lets providers focus on client-issuer value, not the technical plumbing.

Today, as XBRL becomes table stakes for credible ESG, Danish Mir’s foresight positions BriskFlow as the indispensable enabler. “We’re not competing with platforms; we’re empowering them,” Danish Mir, BriskFlow Founder, commented.

BriskFlow: An OEM XBRL Layer for ESG Providers

At its core, BriskFlow is engineered as the sole OEM layer tailored for XBRL-ESG integration in the market – a deliberate design choice to democratize structured reporting for service providers. Unlike comprehensive end-to-end platforms that demand full migrations, BriskFlow slips seamlessly into your ecosystem via a developer-friendly API. Providers can white-label the entire tagging engine, branding it as their own premium module while leveraging BriskFlow’s AI to automate 85% of the tagging workload.

The API’s magic lies in its simplicity and power: A single endpoint call pulls data from the platform’s backend -be it carbon calculators, governance dashboards, or ERP syncs—and maps it to taxonomy elements like ESRS for Scope 3 emissions or IFRS S2 for climate risks. Outputs? Instant iXBRL exports with embedded audit trails, dynamic block tagging for narratives, and validation against regulator rules. For ESG consultants, this means scaling from one-off reports to portfolio-wide automation. SaaS builders add XBRL as a differentiator, unlocking upsell revenue without R&D overhead. Early integrations with Nordic advisory firms and U.S. climate SaaS players have yielded 70% faster client onboarding, per platform metrics.

“Being a sustainability-first OEM layer in this space isn’t hyperbole—it’s our north star,” said BriskFlow Founder Danish Mir. “ESG providers shouldn’t reinvent XBRL wheels; they should embed them effortlessly to serve clients better.” Beta testers echo this, citing zero-downtime deployments and taxonomy-agnostic flexibility that adapts to evolving rules like ISSB standards.

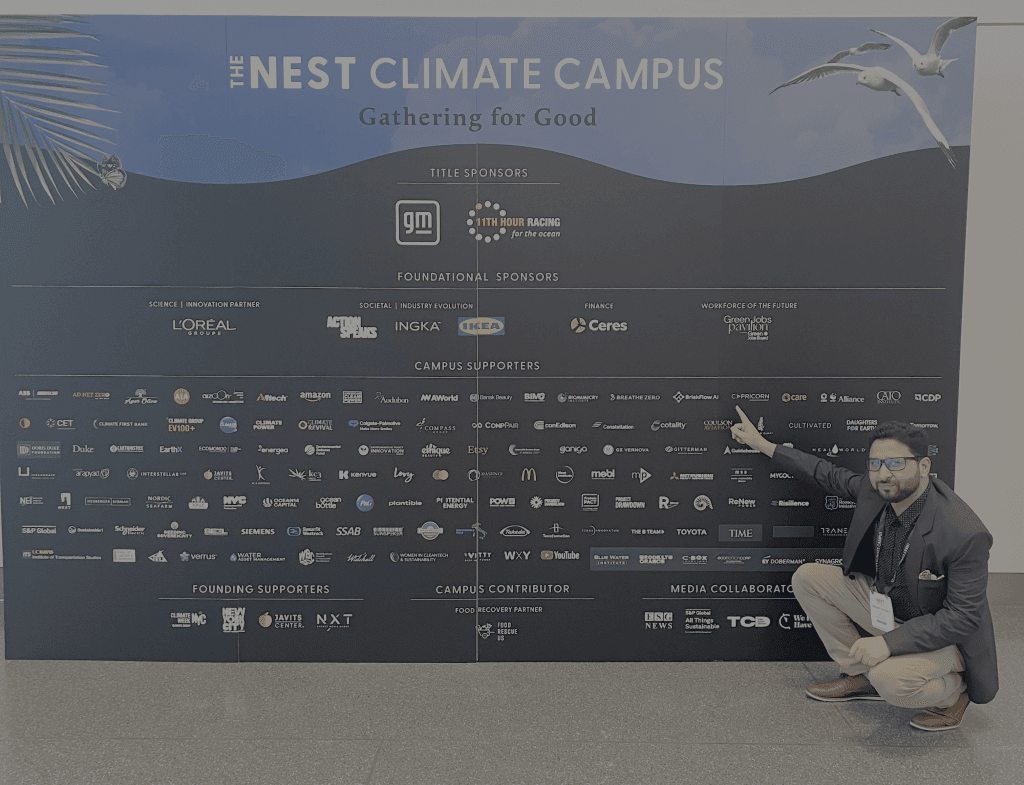

From Nasdaq’s Frontlines to BriskFlow’s Vision

BriskFlow was founded by Danish Mir, former product owner for Nasdaq’s Sustainability Reporting SaaS, Metrio. With an engineering background, double master’s degrees in Sustainability (UN University) and Information Management (UMD), and a decade-plus track record in ESG technology, Mir sits at the rare intersection of sustainability expertise and technical depth.

Mir describes when the question of XBRL-tagged sustainability disclosures landed on his team’s roadmap at Nasdaq, we assessed every option—building internally, acquiring a solution, or partnering. Despite the resources and engineering depth, the economics were clear: developing or buying an XBRL engine for ESG was prohibitively costly. The only viable path was to partner with financial-reporting vendors who historically built tagging engines for traditional financial statements.

For Mir, that moment was transformative. If Nasdaq—equipped with decades of financial-reporting experience—found the barrier high, it was inevitable that hundreds of sustainability platforms, climate software providers, and ESG consultants lacked the capacity to solve it at all. The market needed an independent, purpose-built XBRL layer that anyone could embed.

RELATED ARTICLE: GRI Launches Machine Readable Taxonomy To Streamline Global Sustainability Reporting

According to Mir, that insight became the foundation of BriskFlow’s vision: “to democratize structured sustainability disclosures by building the XBRL-ESG infrastructure that the entire industry had been missing.”

Why BriskFlow’s OEM Uniqueness Could Redefine the ESG Landscape

In a sea of 300+ ESG tools—from data collectors like Sphera to analytics hubs like Watershed—XBRL integration is a rare superpower, and BriskFlow’s OEM focus makes it unparalleled. Platforms like IRIS CARBON and Workiva offer XBRL capabilities, but they also compete in the sustainability reporting space. For carbon accounting SaaS providers, this creates a strategic dilemma: today’s partner could become tomorrow’s competitor. BriskFlow is different: we’re purely an XBRL layer, and we intend to stay that way. No plans to enter carbon accounting, ever. This exclusivity fosters trust and rapid adoption: providers integrate once, then offer XBRL to all clients indefinitely, cutting costs by up to 70% and boosting interoperability.

Cross-collaboration thrives here too. BriskFlow’s outputs feed into broader ecosystems – syncing tagged ESG with financial iXBRL for unified reports or AI models for risk forecasting – aligning with trends like the IFRS Foundation’s push for digitized standards. As regulators like ESMA finalize taxonomies, BriskFlow’s proactive updates ensure providers stay ahead, turning compliance into a moat.

OEM Integration as New ESG Standard

This XBRL launch marks a tipping point: ESG reporting isn’t about isolated apps anymore; it’s about interconnected layers that amplify impact. For providers, BriskFlow’s API is the easy entry to structured data excellence -enhancing suites without the hassle. Enterprises and consultants gain audit-ready outputs; investors, the comparability they’ve craved.

Danish Mir envisions a ripple effect: “NASDAQ’s legacy institutional compliance taught me that innovation scales through collaboration. BriskFlow is positioning itself as a new connector for global issuers and ESG data.”

Get social updates, follow ESG News on LinkedIn