Category: ESG Investing

Leadership shift reflects rising ESG demands in private markets London based global asset manager Schroders has appointed Holly Turner as Head of Sustainable Investments at Schroders Capital, elevating a long...

Renewable Infrastructure Returns To Public Markets U.S. solar and battery storage contractor SOLV Energy entered public markets with momentum on Wednesday, opening above its listing price and reaching a valuation...

Global Capital Targets Australia’s Grid Flexibility Challenge KKR has agreed to invest up to A$600 million ($603 million) into HMC Capital’s Energy Transition Platform, deepening institutional backing for battery storage...

Austin Court Halts Texas Anti-ESG Framework A federal judge in Austin has struck down Texas’s controversial anti-ESG statute, Senate Bill 13, delivering a major legal setback to one of the...

Copenhagen Infrastructure Partners has agreed to acquire Ørsted’s European onshore renewables business, transferring a portfolio of more than 800 MW of operating and under-construction capacity alongside a multi-gigawatt development pipeline...

British International Investment has committed $33 million to GreenCell Mobility as India accelerates the shift from diesel fleets to zero emission public transport. The financing forms part of an $89...

• Total committed capital now $460 million toward a $500 million target for Asia focused climate investments• Blended finance structure mobilizes private capital into renewable energy, battery storage, efficiency and...

• $100 million Series C financing led by Decarbonization Partners, a joint venture of BlackRock and Temasek• Investment pushes osapiens to unicorn status, building on Goldman Sachs Alternatives and Armira...

Morningstar Sustainalytics has won an Environmental Finance 2025 IMPACT Award, receiving top honors in the Impact Research category for its work advancing transparency in sustainable finance. The award recognizes Sustainalytics’ flagship research series, SFDR Article...

Karl Naïm, Chief Commercial Officer at XBTO at ADFW - Panel Session: “Mapping Asset Allocation: Making Sense of Modern Portfolios”

Nordea Asset Management (NAM) has appointed Rachel Reutter as Portfolio Manager within its Sustainable Thematic Team, reinforcing its impact investing capabilities as institutional investors sharpen their focus on measurable outcomes,...

Nordea Asset Management (NAM) has appointed Kasper From Larsen as Portfolio Manager within its Sustainable Thematic Team, strengthening its climate investment bench as asset owners increase scrutiny on transition credibility,...

ISS STOXX acquires ECPI to expand sustainability offering ISS STOXX acquires ECPI under a definitive agreement announced today, strengthening its position in sustainability indices, data, and analytics for institutional investors....

As European governments push to decarbonize transport systems under tightening climate targets, private capital is moving to fill a widening infrastructure gap in rail. KKR has agreed to acquire a...

Colesco Capital has agreed to take over the management of an Article 9 impact credit fund focused on financing circular economy and climate transition businesses, a move that significantly expands...

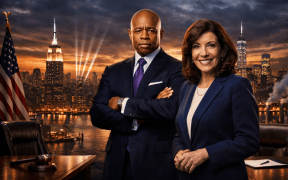

New York’s new mandatory greenhouse gas reporting regime is more than an environmental regulation. It represents a structural shift in how verified emissions data will influence ESG investing, risk pricing,...

• AXA Investment Managers has launched a UK domiciled global core credit fund with a formal net zero decarbonization objective, seeded by LifeSight with up to £1bn ($1.27bn) expected by...

PME pulls €5bn mandate from BlackRock BlackRock loses a second Dutch pension mandate in a matter of months after PME, a pension fund for workers in the metal and technology...

• Global Infrastructure Partners, part of BlackRock, will invest up to USD 335 million in Aditya Birla Renewables Limited for a minority stake, valuing the platform at roughly USD 1.64...