China’s Internet Sector Leading the ESG Charge, KESG Captures

It’s been a rollercoaster year for the internet sector in China, with regulations heavily impacting companies and investor sentiment last summer. While the companies have since recovered and are generally thriving, questionable sentiment about investment in China remains for many foreign investors.

KraneShares discusses the contributions and goals of many of the largest current contributors to ESG within China in a recent paper. The top companies are found primarily within the internet sector. These companies have adhered to regulations and are looking ahead to growth while seizing opportunities to contribute to the betterment of society and reduce harmful environmental practices.

“ESG investors believe that factors such as a company’s contribution to society’s well-being may be better predictors of its long-term performance than technical valuations alone,” KraneShares writes. “Recent policy guidance from China’s leadership acknowledges investors are also key stakeholders whose interests must be considered as reforms are rolled out.”

See related article: Ping An Life becomes first China insurance company to issue ESG bond index

China’s focus in this economic cycle is “Common Prosperity”, with regulations and growth focused on narrowing the wealth divide and setting China up for resilient, long-term growth. It’s an initiative that the biggest internet companies in China have contributed to financially, beginning in September 2021 with Alibaba’s announcement of a $15.5 billion investment by 2025 and Tencent pledging $7.7 billion. The “Common Prosperity” fund will provide greater subsidies for small and medium-sized businesses, as well as improve insurance, wages, and protections for gig workers.

Internet companies are some of the largest consumers of coal-reliant electricity to run their data centers, and with a focus on reaching peak emissions by 2030 in China and net-zero by 2060, Chinese internet companies are taking action to reduce their footprint. Tencent Cloud has transitioned to using renewable energy cooling technology in one of its major data centers, reducing 34,300 tons of carbon dioxide each year. Alibaba has begun the use of a packaging optimization algorithm to reduce packing material usage by 15%.

“China’s internet platforms serve as the model for how companies can thread the line between balancing society’s interests with their shareholders’ interests. As a result, they dominate the ESG rankings in China,” writes KraneShares.

As of March 31, 2022, the top three securities within the MSCI China ESG Leaders Index were Tencent, Alibaba, and Meituan, a popular food-sharing company that was impacted by regulations but has since recovered and is experiencing strong growth while allowing small businesses to pay significantly less in fees.

ESG Outperforms in China

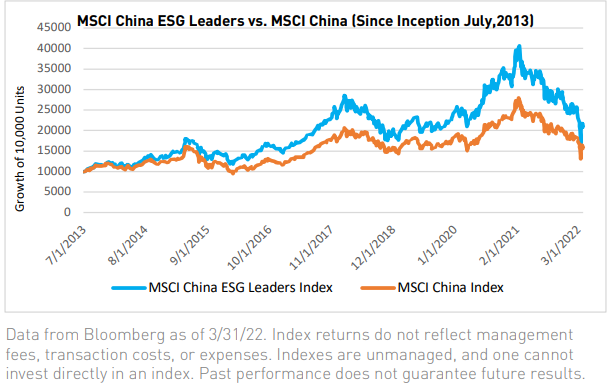

The highest-scoring ESG companies in China historically outperform the broader Chinese markets. Since the creation of the MSCI China ESG Leaders Index in 2013, it has outperformed by roughly 58% compared to the broad MSCI China Index.

The KraneShares MSCI China ESG Leaders ETF (KESG) invests in the leading ESG companies within China, and because of its sector diversification, it has been able to mitigate much of the regulatory risk within China in the past year.

The fund seeks to track the MSCI China ESG Leaders 10/40 Index, an index that is free float-adjusted and market cap-weighted. It includes companies with high ESG ratings compared to their peers within their industries. The index includes all types of publicly issued shares from Chinese issuers from all market caps and screens out any issuers that have any controversies according to the UN Declaration of Human Rights, the International Labor Organization Declaration on Fundamental Principles and Rights at Work, and the UN Global Compact. The index also screens out any companies that are involved in alcohol, tobacco, civilian firearms, gambling, nuclear power, and conventional and controversial weapons.

The index is comprised of securities from the following sectors: consumer discretionary, industrials, financials, communication services, healthcare, real estate, utilities, consumer staples, information technology, materials, and energy. Securities included make up the top 50% market cap of their sector, and no single security can make up more than 10% of the underlying index, while no sector accounts for more than 40% of the index.

KESG has an expense ratio of 0.58%.

Source: NASDAQ