Cohesion Releases Comprehensive Guidebook to Simplify ESG Regulations and Reporting Strategies in Commercial Real Estate

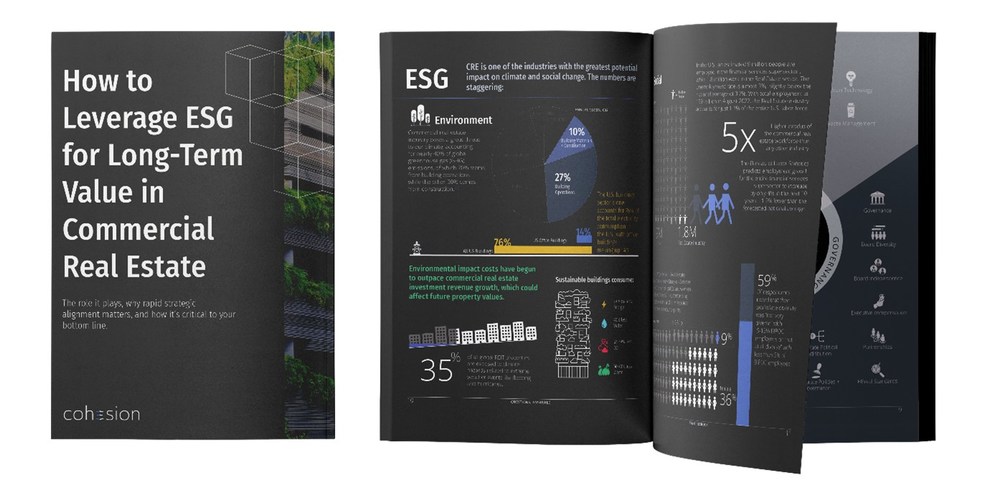

To bring much-needed clarification on environmental, social, and governance (ESG) regulations and reporting strategies in the commercial real estate industry (CRE), Cohesion, a Chicago-based smart building technology company, has released a comprehensive guidebook: How to Leverage ESG for Long-Term Value in Commercial Real Estate.

“As a proptech company paving the way to new, easier ESG reporting practices, we found bringing clarity to the complicated regulatory process was necessary,” said Thru Shivakumar, CEO and Co-Founder of Cohesion. “We created this guidebook to offer a more comprehensive understanding of the role CRE plays in global sustainability, what is happening and how to prepare for the changing demands.”

See related articles: Three Commercial Real Estate CEOs Committed To ESG, Enertiv Expands Platform to Help Commercial Real Estate Tackle Long-Term Decarbonization Goals, Building Ventures Launches $95 Million Second Fund To Continue Driving Innovation in Built Environments

This guidebook clarifies how building a strategy right now, with rapid, top-down alignment and adoption in a measurable and sustainable way, improves business outcomes and raises asset value. CRE professionals can immediately gain an action plan and simple process to follow when approaching ESG adoption:

- Identify where your company lands on the ESG adoption curve against where you want to be.

- Take an internal look at your operations and determine your core competencies that can feed into your ESG strategy.

- Partner with 3rd party organizations and smart building technology to help you on your ESG journey.

- Outsource your ESG data acquisition and reporting strategies to the experts.

- Disclose your efforts to both internal and external stakeholders.

CRE is responsible for 40% of the world’s greenhouse gas emissions, 70% of which stems from building operations while the remaining 30% is from new construction. Environmental impact costs have begun to outpace investment revenue growth, which will affect future property values if the industry continues down the path it is currently paving.

ESG investing accounts for nearly 25% of all professionally managed assets in the world. In 2021, over $.5T USD circulated through ESG funds, marking a 55% growth in ESG-integrated products. Evidence suggests implementing ESG initiatives corresponds directly with government and customer support, reduced regulatory intervention, and increased employee productivity.

“Everyone in the industry wants to be a pioneer. Adopting a robust ESG strategy is a means to gain the competitive advantage everyone is chasing while ensuring a portfolio is resilient,” said Shivakumar. “The real estate industry is in a transformative state and those owners and operators seeing opportunities rather than challenges really shine and outperform the competition through data and ESG strategies.”

Source: Cohesion