IFRS Foundation, IDB Partner to Accelerate Adoption of Sustainability Disclosure Standards in Latin America

- Regional Focus: A new partnership aims to fast-track adoption of IFRS Sustainability Disclosure Standards across Latin America and the Caribbean.

- Private Sector Integration: The agreement includes targeted tools—knowledge sharing, capacity building, and policy engagement—to help companies implement disclosures.

- Market Confidence: Greater transparency is expected to boost investor confidence and strengthen capital markets.

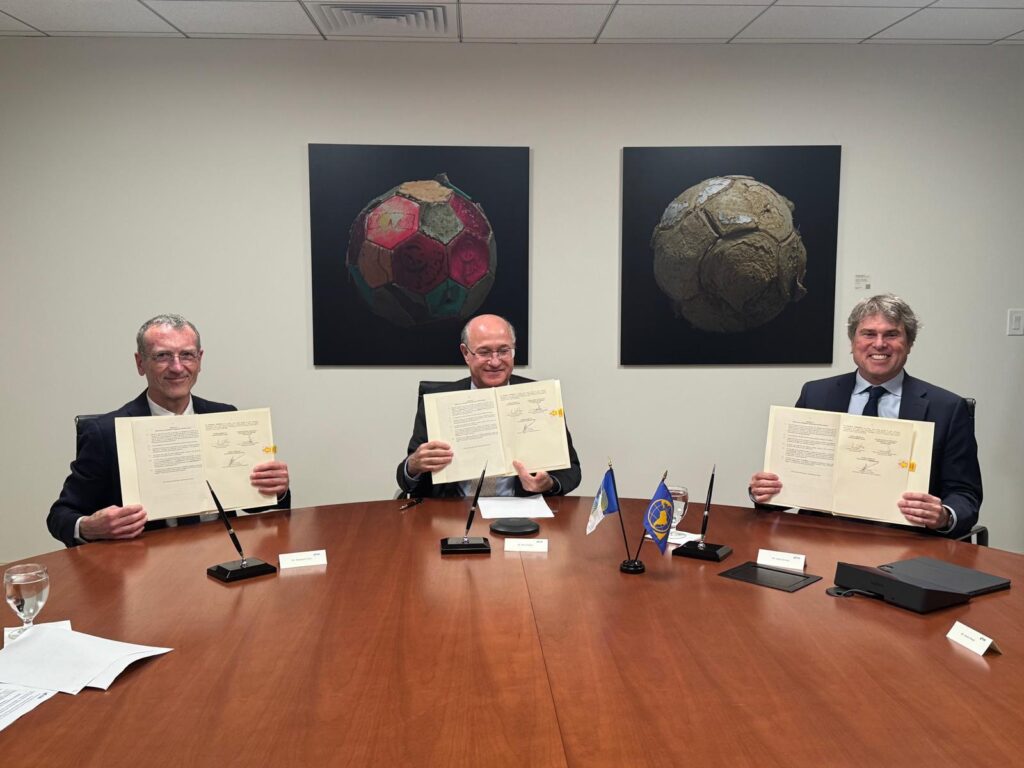

The Inter-American Development Bank (IDB), IDB Invest, and the IFRS Foundation have launched a strategic partnership to promote the adoption and implementation of the IFRS Sustainability Disclosure Standards throughout Latin America and the Caribbean.

The initiative centers on an action plan designed to support both public and private sectors. It includes tools for knowledge sharing, capacity building, and policy engagement, aimed at equipping markets with the frameworks needed to align sustainability disclosures with global investor expectations.

“The IFRS standards help issuers, investors and regulators make informed decisions and align incentives. Transparency builds trust,” said IDB President Ilan Goldfajn. “This partnership is about accelerating the adoption process across the region and help in its implementation.”

The IFRS Sustainability Disclosure Standards—developed by the International Sustainability Standards Board (ISSB)—serve as a global benchmark for disclosing sustainability-related risks and opportunities. These standards are tailored to improve the flow of consistent, decision-useful information to capital markets.

RELATED ARTICLE: IFRS Foundation Publishes Guide to Help Companies Identify, Disclose Sustainability Risks

“Public authorities across Latin America and the Caribbean have signalled their belief that IFRS Sustainability Disclosure Standards can help strengthen capital markets, enhancing transparency and understanding around sustainability-related risks and opportunities,” said Michel Madelain, IFRS Foundation Managing Director. “Our partnership with the Inter-American Development Bank Group will deliver to these markets critical support to benefit from the full potential of effective sustainability-related disclosure in the region.”

With growing demand from institutional investors for reliable ESG data, this move marks a pivotal step toward enhancing financial stability and sustainability accountability across emerging markets in the Western Hemisphere.

Follow ESG News on LinkedIn