Japan’s ESG Investments Surge as 311 Companies Join FTSE Blossom Japan Index: FTSE Russel Report

Key Impact Points:

- 311 Companies: As of March 2024, 311 companies are included in the FTSE Blossom Japan Index, up from 255 in the previous year.

- Increased Volume: SGX FTSE Blossom Japan Futures reached a new daily average volume of US$13.8 million in June 2024, a 26% year-on-year increase.

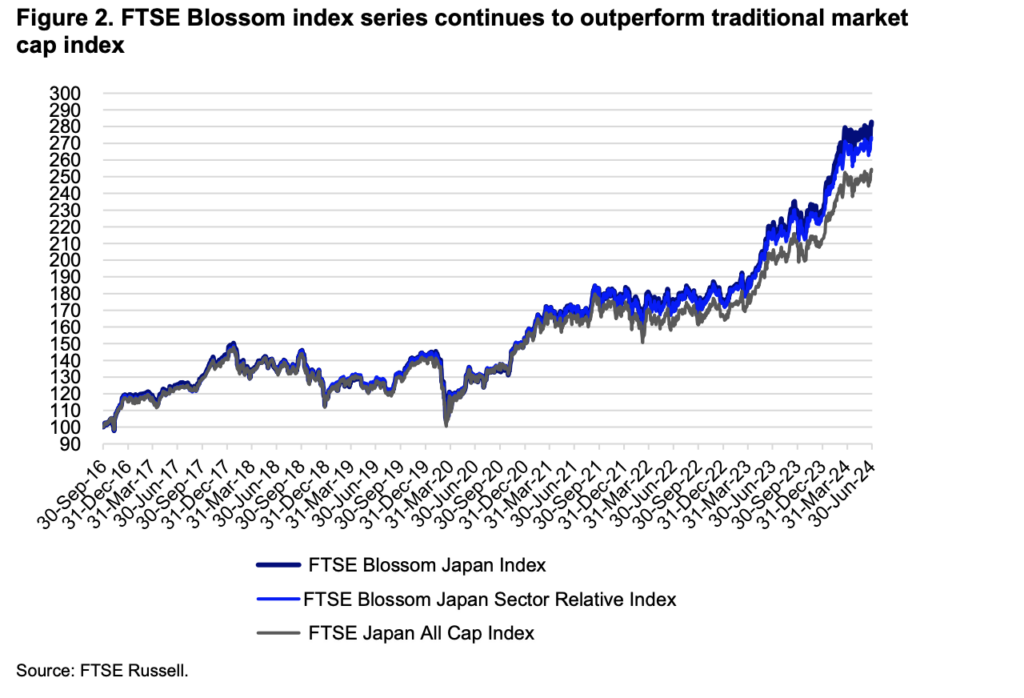

- Outperformance: Both the FTSE Blossom Japan Index and the FTSE Blossom Japan Sector Relative Index outperformed the broader market in Q2 2024.

ESG investment in Japan is accelerating, driven by a mix of policy support and growing investor interest. Public pension funds signing the Principles for Responsible Investment (PRI) and the expansion of the Nippon Individual Savings Account (NISA) are key factors supporting this growth. The latest report, labeled “Evolution of corporate ESG disclosure and expansion of ESG investment“, highlights the significant strides Japan is making in sustainable finance.

As of March 2024, the FTSE Blossom Japan Index included 311 stocks, a notable increase from 255 in March 2023. This selection is based on companies with a FTSE ESG score of 3.3 or higher, indicating improved ESG disclosure and performance. These high-ESG-scoring companies are becoming increasingly attractive to investors, aligning with global trends of incorporating ESG factors into financial strategies.

Performance and Growth in ESG Indices

The report also emphasizes that both the FTSE Blossom Japan Index and the FTSE Blossom Japan Sector Relative Index outperformed their benchmark, the FTSE Japan All Cap Index, in Q2 2024. This sustained outperformance underscores the rising importance of ESG factors in Japan’s stock market and their impact on long-term corporate value.

Moreover, the SGX FTSE Blossom Japan Futures market reached new heights, with daily average volumes hitting US$13.8 million in June 2024, a 26% increase year-on-year. Open interest also peaked at US$173.7 million in March 2024, showcasing strong market demand for ESG-linked financial instruments.

Related Article: FTSE Russell Launches Two New Fixed Income Indices to Support Investors’ Climate Commitments Using TPI Data

Increased Disclosure Driving Investment

Japan’s shift towards greater ESG disclosure is evident from the report’s findings. As more Japanese companies improve their ESG transparency, investment opportunities in sustainable finance grow. The report also notes the substantial 1.5 times increase in assets under management (AUM) within the FTSE Blossom Japan Index series, which reached approximately JPY 2.9 trillion (US$19.7 billion) as of March 2024.

This increase in ESG disclosure is not only attracting more investment but also enhancing the long-term resilience of Japanese companies by aligning them with global sustainability goals.

Japan’s robust development of ESG indices and its continuous push for improved corporate sustainability is positioning the country as a leader in the global ESG space, further solidifying its attractiveness to investors seeking long-term value through sustainable investments.