Qatar’s Al Mana Holding Commits $200M to Egypt Sustainable Aviation Fuel Plant

• $200m SAF investment marks the first Qatari industrial project in Egypt’s Suez Canal Economic Zone, anchoring bilateral capital flows.

• Facility targets 200,000 tonnes a year of SAF and biofuels, with Shell contracted to purchase 100% of output from 2027.

• Project aligns Egypt’s industrial policy with global aviation decarbonization mandates and fuel transition pathways.

Qatar’s Al Mana Holding has signed a $200m agreement to develop a large-scale sustainable aviation fuel production facility in Egypt’s Suez Canal Economic Zone, positioning the country as a regional hub for aviation decarbonization while deepening economic ties between Cairo and Doha.

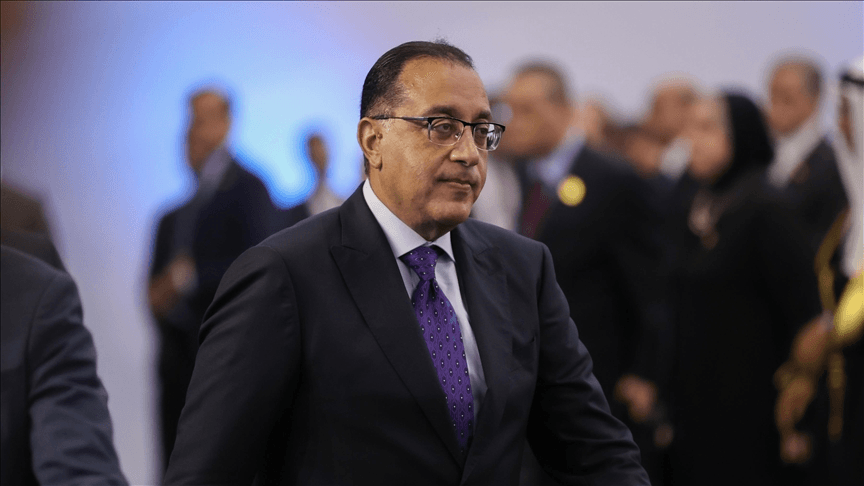

The contract, signed on Sunday at Egypt’s New Administrative Capital and witnessed by Prime Minister Mostafa Madbouly, establishes the first Qatari industrial investment inside the zone. The project will be executed by newly formed Saf Fly Limited and will produce 200,000 tonnes annually of sustainable aviation fuel, BioPropane, and Bio Naphtha derived from refined used cooking oil.

A Strategic Industrial Bet on Aviation Decarbonisation

Al Mana Holding has secured a long-term offtake agreement with Shell covering the plant’s entire production output, with supply scheduled to begin by the end of 2027. Full offtake from a global energy major provides revenue certainty for the project and underscores the growing role of long-term purchase agreements in scaling SAF supply.

Prime Minister Madbouly said the project strengthens the economic zone’s renewable energy credentials while supporting aviation’s transition toward lower-carbon fuels.

“The project reinforces the economic zone’s capabilities in adopting renewable energy sources and supports the aviation sector in line with global environmental standards,” Madbouly said.

The announcement coincided with the Egyptian-Qatari Business Forum held in Cairo, where Madbouly framed the deal as evidence of improving political and economic alignment between the two countries.

“The deal demonstrates positive developments in relations between Cairo and Doha, reflecting a desire by both leaderships to boost bilateral ties and increase joint investments,” he said.

Infrastructure, Incentives, and Emissions Impact

The facility will be located in the Sokhna Integrated Zone, covering a total area of 100,000 square metres. Of this, 70,000 square metres will sit within the industrial area, while 30,000 square metres will be located at Sokhna Port. The integrated design allows direct access between production facilities and port infrastructure, enabling immediate export of finished fuels and import of feedstock.

The $200m investment, equivalent to roughly EGP 9.6bn, aligns with the Suez Canal Economic Zone’s strategy to attract capital into energy-intensive, export-oriented manufacturing linked to global decarbonisation supply chains.

RELATED ARTICLE: BlackRock, Block, and Partners Drive $200M Investment in Sustainable Aviation Fuel

Walid Gamal El-Din, Chairperson of the SCZONE, said environmental sustainability sits at the core of the zone’s development model.

“The project leads to a reduction in harmful emissions by rates ranging between 50-80% compared to traditional fuel,” Gamal El-Din said. He added that the zone’s infrastructure, access to diversified energy sources, and legislative incentives have positioned it as “an optimal destination for investment.”

Investor Confidence and Political Backing

Abdulaziz Al Mana, CEO of Al Mana Holding and Chairman of Green Sky Capital, highlighted Egypt’s investment environment and political support as decisive factors behind the decision.

He praised the backing of political leadership in both Egypt and Qatar, describing the SAF facility as “a distinguished partnership” that combines industrial scale with climate-aligned objectives.

The contract was formally signed by Captain Ahmed Gamal, SCZONE Vice Chairperson for the Southern Zone, and Saad Mohammed Al Mana, Board Member of Al Mana Holding.

Why It Matters for Global Capital and Policy

For investors and aviation stakeholders, the project illustrates how SAF deployment is moving beyond pilot initiatives toward industrial-scale production anchored by long-term offtake agreements. With regulators in Europe, Asia, and the Middle East tightening mandates on aviation emissions, demand for certified SAF supply is expected to accelerate sharply over the coming decade.

Regionally, the investment strengthens Egypt’s positioning as a manufacturing and logistics platform linking Gulf capital with European and global fuel markets. Globally, it reflects a broader shift in climate finance toward projects that combine energy transition goals with trade, infrastructure, and geopolitical alignment.

As aviation faces mounting pressure to decarbonise without sacrificing connectivity, projects such as Sokhna’s SAF facility signal where capital, policy, and supply chains are beginning to converge.

Follow ESG News on LinkedIn