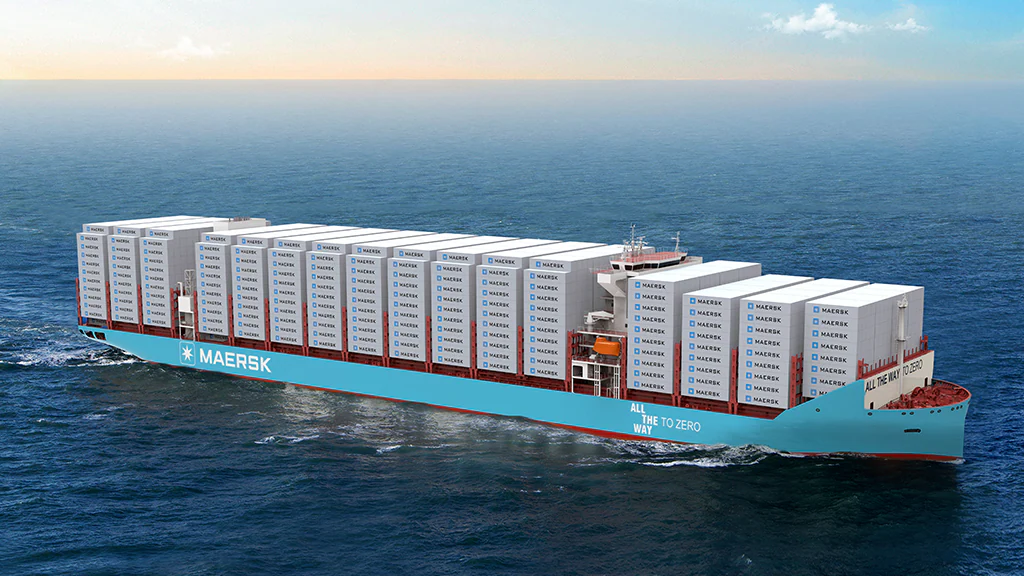

Shipping Giant Maersk taps $750M Investment for First Dollar Green Bond

A.P. Moller-Maersk, the world’s largest container shipping company, has issued a $750 million green bond to finance its decarbonization efforts. The bond, which matures in 10 years, will yield 1.65 percentage points above Treasuries.

“This green bond is a testament to Maersk’s commitment to reducing our greenhouse gas emissions,” said Soren Skou, CEO of Maersk. “We are working hard to decarbonize our fleet and our operations, and this bond will help us make progress towards our net zero goal.”

The proceeds from the bond will be used to finance or refinance green assets, which may include fixed assets, capital and operating expenses, as well as acquisitions of firms that derive at least 90% of their revenue from activities such as clean transportation and green buildings.

“We are pleased with the strong demand for our green bond,” said Carolina Dybeck Happe, CFO of Maersk. “This shows that investors are increasingly interested in supporting companies that are taking action to address climate change.”

However, the company’s green bond faces some challenges. The shipping sector is facing pressure to decarbonize, but it is a complex and expensive process. Maersk is also facing a slowdown in demand for container shipping, which could put pressure on its financial performance.

Related Article: Maersk and Amazon partner to reduce GHG emissions in Ocean Shipping

“The shipping industry is facing a number of challenges, but we are committed to decarbonizing our fleet,” said Skou. “We believe that this is the right thing to do for the environment and for our business.”

The bond sale is a test of investor demand in the US for green bonds. Sales of sustainable bonds have plunged in the US amid a political backlash against investments tied to environmental, social and governance goals. However, Maersk’s strong credit rating and commitment to decarbonization could help it attract investors.

“We are confident that this bond will be successful,” said Dybeck Happe. “We have a strong track record of decarbonization, and we are committed to making progress towards our net zero goal.”

Maersk is working to reduce its greenhouse gas emissions to net zero by 2040, a decade earlier than its initial 2050 ambition, the company said in January 2022. Its 2030 targets include a reduction by half in emissions per container transported by the Maersk Ocean fleet and a 70% reduction in absolute emissions from fully controlled terminals, according to the statement.

The bond was managed by Barclays Plc, Citigroup Inc., HSBC Holdings Plc, JPMorgan Chase & Co. and Morgan Stanley.

Source: Bloomberg