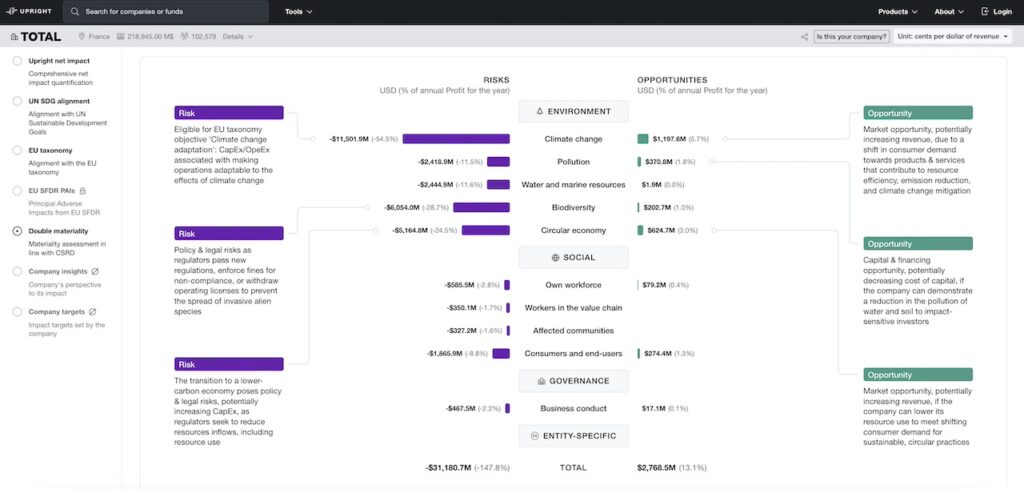

Upright Launches Double Materiality Database Covering 50,000+ Companies for CSRD Compliance

- First-ever scalable database for double materiality covering over 50,000 companies.

- Enables efficient CSRD compliance for companies.

- Empowers investors to proactively manage ESG-related risks and opportunities.

Upright has introduced the world’s first scalable database offering standardized double materiality assessments for over 50,000 companies. The platform is designed to simplify compliance with the Corporate Sustainability Reporting Directive (CSRD) and enhance investor decision-making.

Despite growing emphasis on CSRD—especially following the EU Omnibus—companies and investors remain hindered by inconsistent data and unclear thresholds.

RELATED ARTICLE: Finnish Company Upright Launches the First-Ever Open Database on Science-based Impact of Funds

Upright addresses this challenge by moving beyond manual review of PDFs to a data-driven, actionable solution.

Anniina Virtaoja, Upright’s Head of Sustainability:

“The real challenge isn’t CSRD itself. Information on double materiality is essential…but many are stuck second-guessing thresholds and manually reviewing PDFs instead of gaining actionable insights.”

Leveraging eight years of expertise in science-based impact quantification, Upright’s platform already serves Euro Stoxx 50 companies, SMEs, and global financial institutions.

For Companies:

- Streamlines the creation or updating of robust double materiality assessments.

For Investors:

- Moves beyond subjective ESG surveys, using comprehensive data to proactively identify sustainability-related risks and opportunities.

Virtaoja adds:

“Is this the final word on double materiality? No. But we sure believe it is better than every company and investor reinventing the wheel.”

Follow ESG News on LinkedIn