BNP Paribas Vows to Slash Oil Lending by 80% by 2030, Fund Renewables

BNP Paribas has already made a major pivot towards financing low-carbon energy production.

Building on expertise developed by its Low-Carbon Transition Group, BNP Paribas is embarking on a new phase designed to rapidly accelerate the transition to a low carbon economy.

This new phase is set to last until 2030, by which time BNP Paribas will have completed transitioning over 80% of its energy production financing activities to the production of low-carbon energies.

BNP Paribas has already made a major pivot towards financing low-carbon energy production.

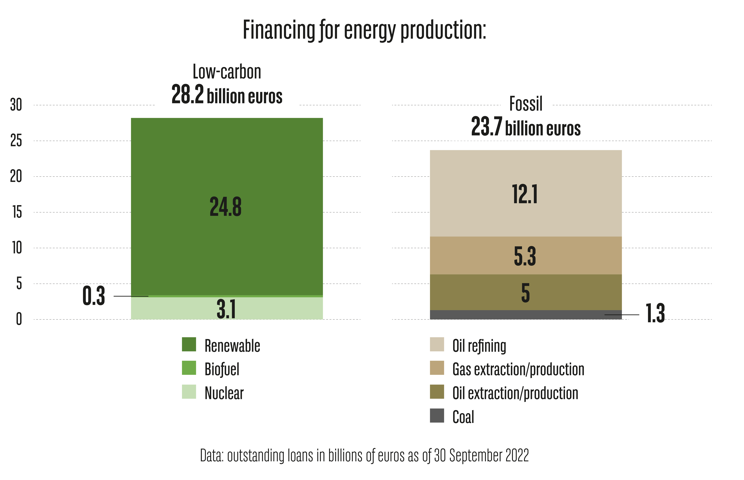

BNP Paribas’ outstanding loans for low-carbon energy production were at more than 28 billion euros at the end of September 2022, already close to 20% higher than those for fossil fuel production.

The Group has secured a leading global position in green bond structuring and placement in 2022, equivalent to $19.5 billion.

An exit path from oil underway: BNP Paribas stopped oil project financing in 2016; a commitment has been made to reduce outstanding financing for oil extraction and production by 25% by 2025.

A coal exit is already well underway, which will be completed by 2030 in OECD member states.

See related article: Iberdrola, CaixaBank, BNP Paribas and Cesce Sign €500 Million Syndicated Green Loan

Building on expertise developed within its Low-Carbon Transition Group, BNP Paribas is embarking on a new phase of rapid acceleration.

Achieve a target of 40 billion euros in outstanding financing for the production of low-carbon, primarily renewable, energies by 2030.

Reduce outstanding financing for oil extraction and production to less than 1 billion euros by 2030, which represents a decrease of more than 80% compared to the current balance of 5 billion euros; to be achieved through scheduled phasing out the financing of specialised and associated activities in the sector.

Focus financing in the gas sector on new generation, low-emission thermal power plants as well as supply security, gas terminals and gas transportation fleets. Outstanding financing for gas extraction and production will thus be reduced by more than 30% by 2030.

This new phase is set to last until 2030, by which time BNP Paribas will have completed transitioning over 80% of its energy production financing activities to the production of low-carbon energies.

Our trajectory is fully in line with the International Energy Agency’s scenario, including its most recent expansions. It is actively and consistently in line with the NZBA (Net Zero Banking Alliance) commitment, as it relates to the energy sector between now and 2050. It will contribute fully to the achievement of objectives promoted within Europe and to broader, global climate ambitions.

“In 2015, when the Paris agreement was signed, financing for the production of low-carbon energy only accounted for a limited part of BNP Paribas’ loan portfolio dedicated to energy production. By 2030, it will represent nearly four-fifths of this loan portfolio. The Group will have achieved 80% of its transition in less than 15 years, confirming its position as the leader among international financing actors,”

Jean Laurent Bonnafé, Chief Executive Officer of BNP Paribas