JLL Report Reveals Tipping Point for Low-Carbon Buildings Demand in Sight

|

Listen to this story:

|

Key findings

The impacts of carbon commitments will materialize in lease markets in the next 12 to 24 months, creating a tipping point where investments in low-carbon buildings will start to pay dividends.

- Corporate occupiers must ensure their next lease allows them to show material progress on their goals – yet they will face challenges as low carbon supply struggles to keep pace with demand.

- Tenants are prioritizing buildings that are energy efficient, free from onsite fossil fuels and powered by clean energy. For construction projects, occupiers are beginning to focus on lower embodied carbon designs.

- This shift is creating both urgency and opportunity for investors who seize this moment and can communicate measurable progress around a building’s carbon performance.

The real estate landscape is undergoing a profound transformation as sustainability takes center stage. In a report titled “The Green Tipping Point” by JLL, key findings shed light on the imminent impact of sustainability in real estate. Is 2024 the year when carbon commitments change lease markets at scale?

Carbon Commitments: A Tipping Point Approaches

According to JLL’s report, the effects of carbon commitments are set to materialize in lease markets within the next 12 to 24 months. This impending shift will mark a tipping point where investments in low carbon buildings will begin to pay dividends. Tenants are increasingly prioritizing energy-efficient, clean energy-powered spaces, reflecting a strategic imperative for corporate occupiers. Investors who seize this moment stand to benefit by communicating measurable progress in a building’s carbon performance.

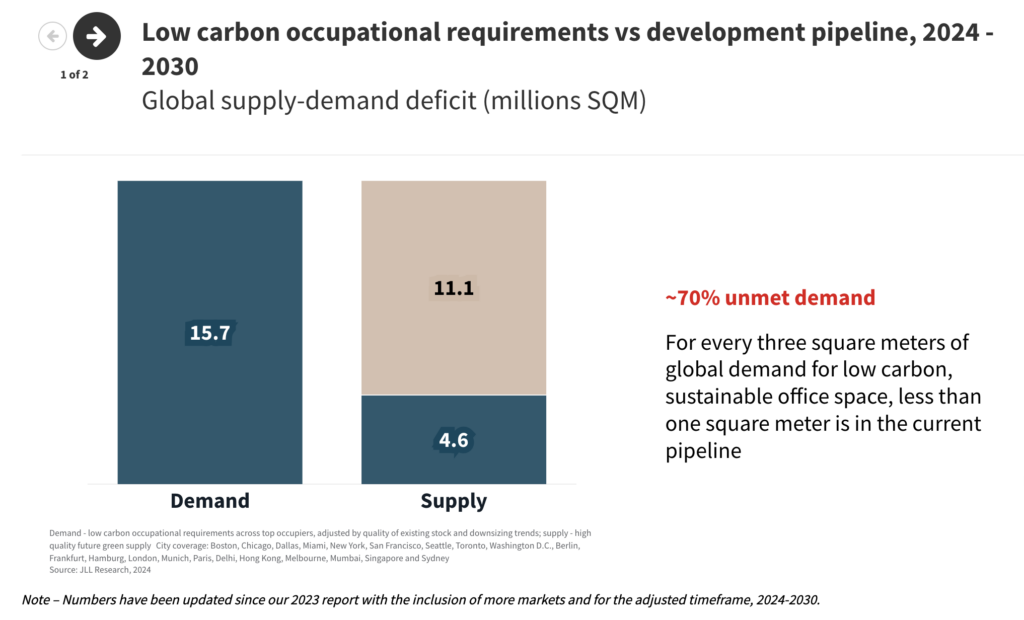

Supply-Demand Dynamics: Striving to Keep Pace

Despite growing demand for sustainable office spaces, the supply of low carbon buildings is struggling to meet expectations. JLL’s research indicates that without increased levels of retrofitting, the gap between demand and supply will widen significantly. By 2025, approximately 30% of the demand for low carbon space may remain unmet, with the potential gap exceeding 70% by 2030. This underscores the urgent need for concerted efforts to accelerate the transition to sustainable real estate solutions.

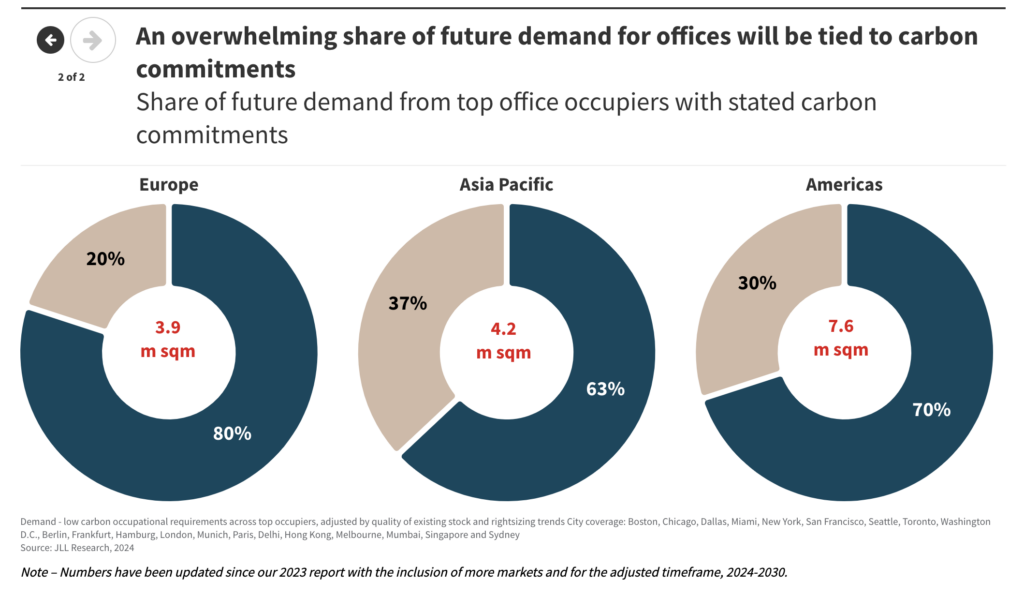

Regional Perspectives: The Varied Landscape of Sustainability

The report highlights the varied supply-demand dynamics across cities, shaped by local regulations and market preferences. In cities like London and Paris, regulatory momentum and progressive attitudes among stakeholders are driving demand for low carbon space. Meanwhile, in New York and Sydney, regulatory measures and market preferences for energy-efficient spaces contribute to significant supply-demand gaps. Understanding these regional nuances is crucial for navigating the evolving sustainability landscape.

RELATED ARTICLE: New Study Finds That 15% of Americans Don’t Believe Climate Change is Real

Policy and Regulation: Catalysts for Change

Policy interventions aimed at decarbonization are gaining traction globally, compelling stakeholders to adopt sustainable practices. Governments and industry bodies are implementing mandatory ESG disclosure rules and building performance standards to promote transparency and accountability. These regulatory measures signal a fundamental shift in real estate practices, encouraging stakeholders to embrace sustainability as the new norm.

Looking Ahead: Navigating Towards Net Zero Carbon

As we approach 2025, a pivotal moment looms for the real estate sector. With less than seven years to halve emissions in line with the Paris Agreement, stakeholders must accelerate efforts towards net zero carbon targets. By 2025, 30% of market demand for low carbon office space may remain unmet, highlighting the urgency for action. Stakeholders must align leasing decisions with sustainability goals to drive tangible progress towards a greener future.

Conclusion: Embracing Sustainability as the New Norm

In conclusion, JLL’s report underscores the transformative impact of sustainability on the real estate industry. As stakeholders navigate the complexities of a rapidly evolving market, embracing sustainability as the new norm will be key to unlocking long-term value and resilience in the built environment. By understanding regional dynamics, leveraging policy interventions, and embracing sustainability commitments, stakeholders can position themselves for success in a greener future.