Category: ESG Funds

Aligned Climate Capital closed its second venture fund, Aligned Climate Fund 2 LP, at $85 million, marking nearly a 200% increase compared to its inaugural fund. This milestone aligns with...

NextEnergy Capital’s NextPower UK ESG (NPUK), the largest dedicated private fund for new-build solar in the UK, has successfully closed fundraising at £733 million—almost 50% above its original target. NPUK...

America’s AI boom demands vast energy infrastructure—but risks massive carbon emissions. Climate-tech innovator Spiritus today announced a $30M Series A funding round, led by Aramco Ventures with participation from Khosla...

Climate Fund Managers (CFM) and Infinitum Energy Group have secured $3.1 million in development funding from CFM’s EU-backed Climate Investor Two Fund to co-develop a waste-to-energy project in Freetown, Sierra...

Major Shift in Asset Management The People’s Pension (TPP) has announced a strategic shift in its asset management approach, appointing European asset manager Amundi and U.S.-based Invesco to oversee £28...

Driving Biodiversity Investment Goldman Sachs Asset Management is introducing its first biodiversity-focused bond fund, expanding sustainable finance options for fixed-income investors. “Most of the existing biodiversity or nature-based solutions funds...

CarbonQuest, a leader in distributed carbon capture technology, has closed a $20 million funding round led by Riverbend Energy Group, with significant contributions from Energy Capital Ventures (ECV) and Aligned...

Climate Fund Managers (CFM) announced the launch of Climate Investor Three (CI3), a blended finance fund targeting the energy transition and green hydrogen sectors. The fund has already secured €150...

Terra CO2, a U.S.-based low-carbon building materials company, has secured $82M in Series B equity commitments to expand its sustainable cement technology. The round was co-led by Just Climate, Eagle...

Mast, North America’s leading post-wildfire reforestation company, secured $25 million in Series B funding to expand its Biomass Carbon Removal & Storage (BiCRS) initiative. The funding, co-led by Pulse Fund...

Jenn Bonine, CEO of Valhalla Capital Consortia, discusses their ESG-focused funding strategy ($5m – $20m) for small business founders with ESG News CEO Matt Bird at the World Economic Forum....

Twelve, a carbon transformation company, has secured an additional $83 million in Series C and project funding, advancing its mission to replace fossil fuels with CO2-derived materials. This brings total...

2024 marked a transformative year for the Green Climate Fund (GCF) as it advanced its mission to empower developing nations facing the climate crisis. Here’s how GCF delivered tangible progress...

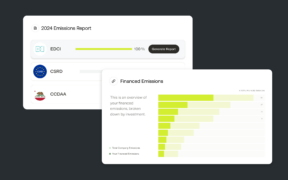

Gravity, a leading carbon accounting and energy management platform, announced a $13 million Series A funding round, led by Ansa Capital and joined by Eclipse, Hanover, Caffeinated Capital, and other...

Algebris Investments has launched its first venture capital fund, Algebris Climatech, with an initial close of approximately €60 million. Institutional investors, including major Italian pension funds and CDP Venture Capital,...

Mobilizing substantial capital: Global impact leader responsAbility Investments has advanced its Asia Climate Strategy to over $350 million in its third funding round, surpassing initial private sector capital mobilization goals....

White Summit Capital has completed the first close of its Decarbonization Infrastructure Fund II, raising over €350 million, surpassing 50% of its €500 million target. Investors include the European Investment...

At COP29, the Multilateral Climate Funds (MCFs)—comprising the Green Climate Fund (GCF), the Adaptation Fund, the Climate Investment Funds (CIF), and the Global Environment Facility (GEF)—announced the launch of the...

Key Impact Points Aviva Investors Launches Carbon Removal Fund Aviva Investors has launched an innovative Carbon Removal Fund (CRF) that offers institutional investors access to a range of high-integrity carbon...

Key Impact Points: The Securities and Exchange Commission (SEC) has charged New York-based investment adviser WisdomTree Asset Management Inc. with making misstatements and failing to comply with its own investment...