Tag: ESG Investing

NetworkFinancials is introducing its first TROVA index called TROVA ESG Index and sharing its performance benefits to the investment management community. TROVA Index is built upon unbiased investment insights and performance...

Business decision makers and knowledge workers agree that at least 50% of the data their company uses on a day-to-day basis should be focused on doing good for the communities...

Carbon Collective, the first online investment advisor 100% focused on solving climate change, announced the launch of climate-focused 401(k) plans for employers. Despite the significant growth of sustainable investing options...

East Ventures, a pioneering and leading sector-agnostic venture capital firm in Indonesia, has officially become a UN Principles for Responsible Investment (UN PRI) signatory as part of its commitment to creating...

Windward, the Predictive Intelligence company applying AI to transform global maritime trade, announced today the launch of the “Russia” sanctions solution as a part of Windward’s Maritime AI platform. The...

New Deloitte survey of 300 senior finance, legal and sustainability leaders shows companies are working toward more reliable — and timely — data, with investments in technology, controls design and implementation...

Financial services company Agard Union Trading has committed to its environmental, social and governance (ESG) strategies by incorporating new sustainable investment opportunities. Agard Union Trading announced today that it would deploy...

The New York Stock Exchange, part of Intercontinental Exchange, Inc., a leading global provider of data, technology and market infrastructure, announced today the launch of the NYSE Sustainability Advisory Council....

Money movers invested in sustainability consulting are turning green into green. Pasadena-based Tetra Tech Inc. announced on Feb. 23 that it would establish a $1 billion sustainability-linked credit facility, backed...

Chicago-based myWHY Agency has announced a unique partnership with Miami-based Lebec Consulting that will capitalize on the strengths of both agencies, to elevate the work done on behalf of clients in...

Bank of Montreal laid out a plan to sharply reduce emissions connected to loans to the energy and power-generation sectors by 2030 as its aims for a longer-term goal of being...

8 Rivers Capital, LLC announced a USD$100 million investment from SK Group, along with the establishment of an 8 Rivers-SK joint venture to focus on decarbonization of Korean and key Asian markets. ...

With a flurry of environmental, social, and governance (ESG) exchange traded funds having come to market in recent years, it’s understandable that some fly under the radar. That’s the case...

Moody’s Corporation launched a new series of pre-recorded insights for stockholders in anticipation of its Investor Day event to be held on March 10, 2022 at the New York Stock...

SolaREIT, a leading solar real estate investment fund, has closed on a $100 million securitization of solar leases with Nuveen. The expansion will significantly increase access to low-cost capital in the commercial...

Cloudbreak Holdings, a multinational natural resources investment firm, has concluded an agreement with Geovic Mining to finance and operate one of the world’s largest cobalt mines, in Cameroon, Africa. Through its subsidiary Phoenix...

Fieldguide, an automation and collaboration platform built to empower audit and advisory firms with the industry’s only end-to-end cloud-native experience designed for complex cybersecurity, ESG (Environmental, Social, Governance), and other...

New research* from Intertrust N.V., a world leader in providing specialised administration services to clients in over 30 jurisdictions, reveals that CFOs continue to fear cost and resource constraints as...

U.S. Bank announced recently that it will leverage Sustainalytics, a Morningstar Company and a leading global provider of ESG research and ratings, to offer environmental, social and governance (ESG) data...

Brown Advisory, an independent and privately held global investment management firm that oversees more than $139.3 billion in client assets and $39.4 billion in sustainable assets as of January 31, 2022, today announces the launch...

Theia Analytics Group, a provider of a complete suite of quantitative, proprietary, data-driven products for simplifying, clarifying, and measuring risks related to regulatory changes that impact organizational governance, today announced...

In a continued effort to strengthen its presence and operations in Bermuda, Elementum, a leading alternative investment manager specializing in collateralized natural catastrophe event reinsurance investments, today announced the addition of...

UNest, a leading fintech company that makes it easier than ever for parents to invest in their kids’ future, today announced that it is adding ESG investments to its lineup of low-cost,...

Aspen Power Partners, a distributed generation platform with the dual mission of accelerating and democratizing decarbonization, recently announced with its latest financing round it has raised $120 million of capital from...

Groups join forces to launch Well-Being Event Series to highlight the rising importance of health and humanity in improving ESG performance and in reimagining the future of corporate culture. The...

Project Canary, the Denver-based climate tech and environmental assessment company raised $111 million in Series B funding, the company announced today. The data analytics company plans to scale its core solutions and expand...

An active proxy voting season for U.S. public companies is expected this year, according to global Fintech leader, Broadridge Financial Solutions Inc.. With the majority of corporations holding annual meetings between...

Indeed, the world’s number one job site, today announced it is investing $10 million to launch “Essentials to Work,” a multi-prong investment to help struggling job seekers in the U.S....

– Announced ‘2022 Shareholder Value Maximization Policy’ based on Total Shareholder Return (TSR), seeking balance between share price performance and shareholder return via growth. – To invest KRW 3-4 trillion...

Slate Asset Management (“Slate” or “the firm”), a global alternative investment platform targeting real assets, announced today that it has launched an impact investment strategy focused on infrastructure and appointed...

Midea Group Co., Ltd. completed USD 450 million 5-year unsecured green bonds, issued at T+98 base points, setting a record of the lowest issuance margin for international U.S. dollar bonds with the...

The Lion Electric Company, a leading manufacturer of all-electric medium and heavy-duty vehicles, has announced the launch of LionCapital Solutions, a new division dedicated to providing customers with flexible financing...

SS&C Algorithmics’ Open Protocol service enables funds to conform to new SBAI standards PRNewswire/ — SS&C Technologies Holdings, Inc. (Nasdaq: SSNC) today announced it has enhanced its Open Protocol risk reporting service...

(BUSINESS WIRE)–Fidelity Investments® today announced the launch of four new Environmental, Social and Governance (ESG) funds — Fidelity Sustainable International Equity Fund (FSYRX), Fidelity Sustainable Emerging Markets Equity Fund (FSYJX), Fidelity...

BlackRock has launched a five sustainable iShares index mutual funds for the UK wealth market. They look to address the gap in the UK wealth market for strategies that help...

The business world is facing an influx of innovation: changing consumer preferences, rapid digital transformation and geopolitical shifts. To help businesses evolve and supercharge their growth enterprise-wide, Mastercard today announced...

Award conferred by CFI.co following analysis by panel of independent judges AUM Asset Management Ltd. is a results-driven investment manager that seeks consistent growth of clients’ wealth, while fully integrating...

Last week, Tesla, a company with a market capitalization of more than $1 trillion, announced “breakthrough” 2021 profits of $5.5 billion. But there is trouble in the company’s supply chain. The...

Globally, ESG investments continue to rise. ESG assets are on track to exceed $53 trillion by 2025 and represent more than a third of the $140.5 trillion in projected total...

The chief investment officer of Schroders Plc says there’s now so much money chasing a limited universe of climate assets that clients need to be aware of the potential pricing...

Firm is a crucial part of UAE’s aim to be net zero by 2050 Persian Gulf petrostates increasingly weighing green bonds Abu Dhabi’s state oil producer is considering a sale...

Global private capital investment firm The Carlyle Group announced a series of sustainable investment goals, including a commitment to achieve net zero greenhouse gas (GHG) emissions across its investments by...

BlackRock outlined new tools and investment strategies it will create to help clients navigate the net-zero transition in a client letter Thursday obtained by Pensions & Investments. The letter was sent to...

Private equity investor Lightsmith Group announced that it has raised commitments of $186 million for the final closing of the Lightsmith Climate Resilience fund, investing in growth-stage technology companies that...

The European Investment Bank (EIB) Group announced that its Board of Directors has approved €3.2 billion of new financing for a series of projects to support climate action, businesses managing...

Nordic financial services group SEB announced the completion of a new green bond offering, raising €1 billion with proceeds aimed at financing green loans. The bank reported strong demand for the...

About this Event: With razor-sharp candor and business smarts, Kevin O’Leary of ABC’s Shark Tank draws on his encyclopedic knowledge of finance, investing, economics, and business to discuss a variety of topics without pulling...

So you want to know more about ESG investments? We got you. We’re excited to deep dive into ESG at the 2022 Virtual Summit. Join over 300 attendees and discover...

Engine No. 1, an investment firm that drives performance by tying companies’ social and environmental actions to economic outcomes, today announced the launch of its first thematic ETF, the Engine No....

Credit ratings agencies face new risks as they throw themselves into the fast-growing business of environmental, social and governance (ESG)-based investing, the U.S. Securities and Exchange Commission (SEC) warned in...

iM Global Partner (iMGP) and Richard Bernstein Advisors (RBA), a renowned asset allocation specialist and among the largest ETF strategists in the US, announce today the launch of the iMGP...

Michelle Dunstan, Chief Responsibility Officer; Senior Investment Advisor—Global ESG Improvers Strategy Jennifer DeLong, Managing Director, Head—Defined Contribution; President—AllianceBernstein Trust Company “In mid-October, the US Department of Labor (DOL) proposed a...

What’s the latest? The European Commission (EC) drafted a proposal for its much-anticipated sustainable investing taxonomy right at the close of 2021. The taxonomy creates a common set of criteria to determine...

PGIM, the $1.5 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU), continues and deepens its focus on environmental, social and governance (ESG) investing with the appointment of...

Anne Simpson Brings 35 Years of International Investment and Academic Expertise to Lead Franklin Templeton’s Global Stewardship, Sustainability and ESG Strategy Franklin Templeton has appointment ESG industry veteran Anne Simpson...

ABOUT THE EVENT The goal of Bitcoin for Advisors is to equip investment advisors with tools to better understand bitcoin, talk to their clients about bitcoin and to work bitcoin...

THE NEXT REVOLUTION: ENTER THE METAVERSE The next dimension of interaction is already here, and it’s built on Web 3, blockchain and virtual reality. Businesses like Facebook and Nike, fashion...

PepsiCo Beverages North America (PBNA) A $35 million investment with Closed Loop Partners that will create the “Closed Loop Local Recycling Fund,” Closed Loop Local Recycling Fund,” is an innovative circular economy...

Blackstone Launches Sustainable Resources Credit Platform

Senior figures at the World Economic Forum (WEF) in Davos have agreed that Environmental, Social and Governance ESG standards are coming – and will soon apply to all industries. And...

Wealthsimple North American Green Bond Index ETF allows investors to benefit from growth in the green bond market and align investing with their values Mackenzie Investments (“Mackenzie”) today announced the listing...

CQS is ‘investigating’ a sustainable CLO for European market CLO yields among highest in alternative credit: Hintze By Tatiana Darie and Nishant Kumar Michael Hintze’s hedge fund is mulling a...

Sustainable assets at BlackRock more than doubled in 2021 as the fund manager’s total AUM broke through the $10 trillion barrier.

Companies whose business activities are centered on ESG principles are likely to attract loyal clients, employees, and financial backers.

Vanguard recently filed an initial registration statement with the U.S. Securities and Exchange Commission to introduce Vanguard Baillie Gifford Global Positive Impact Stock Fund, which is designed to meet the...

Investors have been finding it increasingly difficult to find assets that achieve their required return and meet their ESG needs.

The Canadian Securities Administrators (CSA) today published guidance for investment funds on their disclosure practices that relate to environmental, social and governance (ESG) considerations, particularly funds whose investment objectives reference ESG factors...

Innovative, news-driven data set offers timely, transparent and tailored insights for asset managers to enhance ESG portfolio strategies Dow Jones today announced the launch of its sustainability data to help...

Northampton, MA –News Direct– Antea Group The Crucial ESG Topics to Focus On Right Now ESG-focused business strategy isn’t just a feel-good concept anymore — it’s increasingly necessary to attract...

Crypto is all about community and in 2021 the community spoke loud and clear about its concerns regarding negative environmental impacts, sustainability, the corruption in government and governmental structures, supply...

Value in the new normal: Holding the trust in multinational companies – About The Event Value in the new normal: Investment trusts have often looked to large UK domiciled companies...

Just Capital, the ESG investing research non-profit co-founded by hedge fund billionaire Paul Tudor Jones, ranks the top companies in the U.S. stock market on environmental, social and governance metrics....

Sustainable Investment Festival

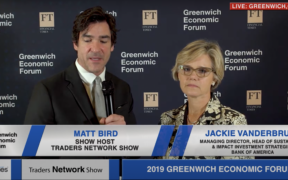

Billy Nauman, Jonathan Bailey, Megan Starr and other thought leaders discuss ESG Investing at Greenwich Economic Forum (Greenwich, CT)

Alpha in a New Era: Economic disruptions typically cause a period of hesitation to participate in markets. In the aftermath of the global financial crisis, investors flocked to haven assets,...

Commercialising Quantum: What does a “quantum future” mean? Commercialising Quantum is coming sooner than you think. The potential for quantum to transform business is so great, with the technology advancing...

Ray Dalio, founder of Bridgewater Associates, deliver special presentation on Corporate Culture at the Greenwich Economic Forum.

David Rubenstein, Co-Founder of The Carlyle Group interviews Chuck Davis, CEO of Stone Point Capital at the Greenwich Economic Forum

HIGHLIGHTS 2018 saw over $254B invested into 18,000 startups globally via venture capital financing Aurora Capital Group Manages over $2B in private equity capital In 2018, 52% of Global VC...

Herman Laret, Charles Van Vleet, Timothy Barrett, Paul Colonna, and Geoffrey Rubin at Greenwich Economic Forum (Greenwich, CT)

Afsaneh Mashayekhi Beschloss interviews David Rubenstein, Co-Founder of the Carlyle Group on ESG Investing at Greenwich Economic Forum

Jay Madia, Mark Burgess and other thought leaders discuss Global Institutional Outlook at Greenwich Economic Forum (Greenwich, CT)

Mohamed El-Erian, Rebecca Breau, and Robert Koenigsberger discuss Emerging Markets at Greenwich Economic Forum (Greenwich, CT)

Megan Starr Head of Principal & Impact for Carlyle Group discuss esg investing with Matt Bird at Greenwich Economic Forum (Greenwich, CT

HIGHLIGHTS Bank of America is the 3rd largest investment bank in the world Bank of America manages $1.08 trillion in AUM Jackie has advised investments around $900 million in gender-mandated...

Speaking at the COP26 summit, Cointelegraph’s editor-in-chief shared expert insights into the potential impact the crypto community could have on environmental initiatives. (Cointelegraph) – Cointelegraph editor-in-chief Kristina Cornèr spoke at...

DUBAI (Reuters) – Standard Chartered Bank (STAN.L)said on Monday it has executed a $250 million repurchase agreement transaction (Repo) based on ESG principles with the Saudi National Bank. The transaction is...

Preqin has estimated that as much as $3.1 trillion of private capital assets under management could have an ESG focus.

J.P. Morgan’s global head of trade, says that ESG considerations can help transform treasury and liquidity management.

Retirement plan sponsors to account for environmental, social, and governance (ESG) is garnering support from the financial services industry

Venture Capital: Following the publication of the PRI’s discussion paper on responsible investment in venture capital in January, this session will explore why ESG in the asset class needs to...

Legal & Governance Trends for Asset Management Firms – This meeting has evolved as the thinking around corporate governance, shareholder engagement, and active litigation has developed and matured. It began...

2022 ESG Trends to Watch – What are the trends and developments MSCI believe investors will see around ESG, climate change and regulations in 2022? When MSCI first published their...

Aviva Investors Above-trend growth, COVID-19, stubbornly high inflation, easing of emergency policy measures and climate change combine to create a heady cocktail of macro themes. Supply chain snarl-ups and China’s...

Europe EQD 2022 is the largest multi-asset, volatility, ESG and cross-asset systematic investing forum for institutional investors in EMEA. The 6th annual Europe EQD event allows asset managers, pension funds,...