Energy Impact Partners Launches Europe Fund with EUR 390 Million from Microsoft, Adia and More

- Supported by financial and impact investors such as Microsoft’s Climate Innovation Fund, APG on behalf of its pension fund client ABP, and Nysnø Climate Investments – a wholly owned subsidiary of the Norwegian Ministry of Trade, Industry & Fisheries

- EIP brings its successful model to accelerate the European climate tech ecosystem, to help Europe-based start-ups expand in North America

- Supported by an industrial coalition focused on decarbonisation, including Microsoft, EDF Group through its corporate venture capital arm EDF Pulse Ventures, and Ferrovial

Energy Impact Partners, a global venture capital firm supporting the transition to a sustainable future, announced its first global expansion with the launch of its European Fund, targeting mission-driven companies advancing the net zero carbon economy. EIP has EUR 390 million to deploy in European investments to accelerate the growth of innovative technologies which have the potential to drive the transition towards net zero.

“Europe is leading in the energy transition and is a key market on the road to net zero where we are seeing thousands of investable opportunities. We are thrilled to now be able to partner with brilliant European entrepreneurs to help accelerate the innovations tackling climate change,” said Hans Kobler, Founder & CEO of Energy Impact Partners. “Our model of collaboration across entrepreneurs, industrial partners, and our highly-experienced team should also make it easier for European technologies to access the North American market.”

The Fund will seek growth and venture investments across the continent, targeting mission-driven companies with established products, markets and customers across the full spectrum of the energy transition. This includes high impact European tech companies that contribute to safer, more flexible and cleaner energy sources.

Image source: Energy Impact Partners

Mirroring the successful strategy of its North American funds, this Fund is structured to enable EIP to partner with European entrepreneurs, supporting their growth and success with a combination of capital and commercial support through EIP’s powerful coalition of industrial firms. EIP’s established presence in North America also offers European companies support to expand in the market and gives founders access to opportunities to exit in North America.Across its platform, EIP has already invested in eleven companies in Europe including:

- Zolar – Renewable energy supplier

- Grover – Subscription provider driving sustainable consumer tech

- EV.energy – EV charging solutions provider

- Instagrid – Portable batteries

- ESG data and technology providers, Greenly and ESG Book

EIP’s collaborative model brings together a global coalition of over 50 forward-looking corporations who are committed to decarbonize the global economy. The partnership-driven model has a proven track record in driving revenues from EIP’s corporate LPs to portfolio companies. The platform has enabled over 350 contracts and delivered more than $1 billion in bookings and business to a portfolio of 100+ companies. The new Fund will bring the partnership-driven model to the European market.

Contributions to the Fund are drawn from a broad set of institutional investors, impact investors and corporates in a range of industries, including energy, utilities, technology and infrastructure and transport. Amongst others, partners and investors in the Fund include a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA), AGL Energy Ltd, APG on behalf of its pension fund client ABP, Chubu, DNV, Électricité de France (EDF) Group through its corporate venture capital arm EDF Pulse Ventures, EWE AG, Ferrovial, Fortum, Galp, Mainova AG, Microsoft’s Climate Innovation Fund, Nysnø Climate Investments – a wholly owned subsidiary of the Norwegian Ministry of Trade, Industry & Fisheries, Shell Ventures and TrønderEnergi AS.

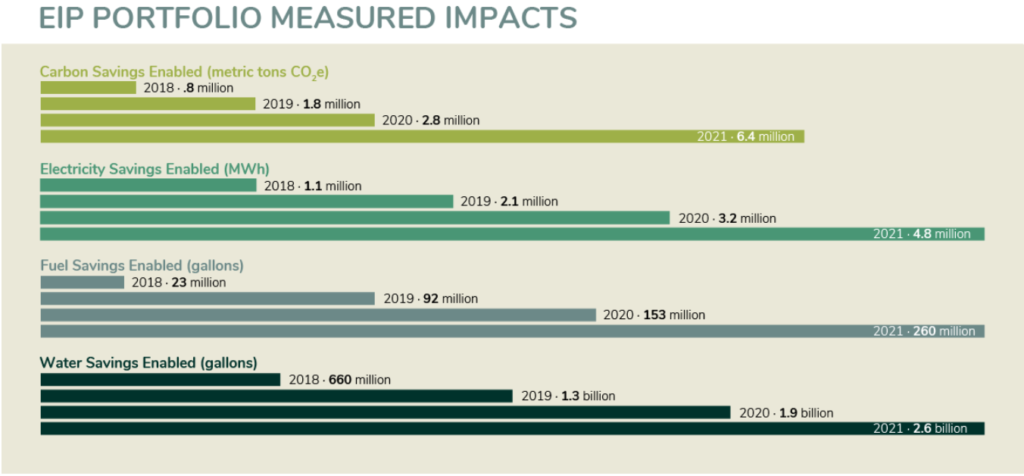

See related article: Energy Impact Partners Releases 4th Annual Industry-Leading Impact and ESG Report

“The energy transition is the most promising investment opportunity of our generation with a global estimated USD $9 trillion to be spent annually. A lot of this money will be spent on new climate-technologies. At EIP, we are deeply rooted in the energy-sector through our industrial coalition and our start-up portfolio. We use this central role to back the brightest founders in their efforts to build the most impactful businesses,” said Matthias Dill, CEO and Co-Managing Partner, EIP Europe.

“We experienced tremendous demand for climate tech as an investment theme among financial and corporate LPs.” said Nazo Moosa, Co-Managing Partner, EIP Europe. “A key challenge for many of these companies is lack of access to larger, more scalable markets. Through our strong foothold in the U.S., and our powerful coalition of industrial partners, EIP’s European Fund is well placed to play a crucial role in scaling up companies to decarbonize asset and carbon intensive industries.”

Brandon Middaugh, Director of the Microsoft Climate Innovation Fund, said: “Microsoft is committed to become carbon negative by 2030. As part of the company-wide efforts, the Microsoft Climate Innovation Fund selected EIP as its first fund investment in climate tech due to the shared vision of a digitized, decarbonized energy system of the future, which will be essential in the clean energy transition.”

Dr. Urban Keussen, Chief Technical Officer of EWE AG, said: “These days the energy transition is becoming even more important not only to reduce CO2 emissions but to replace fossil molecules with green ones and to reduce energy dependency on individual countries. EWE is engaged with EIP to learn from the best, partner with start-ups and collaborate with other industrial investors for the benefit of our customers.”

Source: Energy Impact Partners