Blackbaud (BLKB) Adopts Sustainability Reporting, Boosts ESG Goals

Blackbaud recently announced it has achieved carbon-neutrality across its operations and data centers for 2021.

Further, the company stated plans to adopt the Taskforce and Climate Financial Disclosure (TCDF) framework in its reporting this year and report climate data to CDP. This will ensure transparent reporting of climate-related financial information as the company continues to work toward its climate goals. These disclosures will help the company outline the risks it faces in achieving its carbon goals and plans to minimize these risks. It will also enable the company to set carbon-neutrality targets and measure progress against them.

BLKB’s Carbon-Neutrality Journey

Amid the heightening climate change concerns, Blackbaud has been long committed to operating its business sustainably. The company has been playing its role toward building a green future by calculating and reducing its emissions, using energy efficiently, investing in renewable energy and sustainable projects, and working together with its employees, customers and partners to scale up its endeavors.

Blackbaud commenced its journey toward carbon neutrality by measuring its Scope 1, 2 and 3 emissions. Scope 1 emissions include emissions from owned buildings, Scope 2 emissions are those from sources that are not owned but controlled like leased offices, and Scope 3 emissions are from data centers, cloud services and employees’ work-from-home energy consumption. In order to evaluate its carbon emissions, Blackbaud has invested in renewable energy credits (RECs) and carbon offsets. To account for its Scope 2 emissions, the company purchased Green-eRECs, which funded clean energy generation at a South Dakota wind farm. To reduce the effects of Scope 1 and Scope 3 emissions, Blackbaud is supporting several carbon offset projects.

In its quest to reduce its carbon footprint, Blackbaud shifted to a remote-first workforce strategy in 2021. With the adoption of this strategy, most of the employees are no longer commuting tooffices, thereby reducing the office footprint. This has helped Blackbaud make significant progress toward becoming a zero-waste company and protecting the environment. This hasalso expedited the company’s goals for minimizing environmental impact, in line with its Environmental, Social, and Governance (ESG) commitment. In fact, since 2019, Blackbaud has reduced its global real estate footprint by 50%, lowered the energy emissions required to run its office space by 63% and brought down employee commute emissions by 75%.

With this remote-first strategy, Blackbaud opted for a more flexible, on-demand office and team space, leveraging co-working options worldwide. The company retained one owned office building—its LEED Gold-certified world headquarters in Charleston, SC. This building utilizes solar power, is 30% more energy-efficient and uses 20% less water than other buildings of the same class. Blackbaud even executed robust waste reduction programs to create a healthy and eco-friendly campus.

The latest milestone of achieving carbon neutrality scales up Blackbaud’s recent sustainability progress. In 2021, Blackbaud formed an ESG steering committee to advance its commitment to building a better world. The company also joined the UN Global Compact, which is focused on aligning business activity to the UN’s sustainable development goals.

Earlier this year, the company made a multi-year, six-figure gift to Project Drawdown to accelerate climate solutions worldwide. Project Drawdown is a leader in science-based climate solutions research, communications and engagement—informing, inspiring and influencing current and future climate leaders. Blackbaud’s gift will support Project Drawdown’s efforts to help educators, students, professionals and the general audience interested in climate change and solutions.

Headquartered in Charleston, Blackbaud is a cloud software company working for social causes. The firm combines technology and expertise to help organizations achieve their missions. Blackbaud’s performance is being driven by strength in recurring revenues and bookings growth led by the rapid migration of enterprises to the cloud amid pandemic-induced digitalization. The expansion of the product portfolio, frequent product launches and strategic collaborations bode well.

See related article: Blackbaud Achieves Carbon Neutrality and Commits to New Transparent Sustainability Reporting

However, stiff competition in the non-profit sector, macroeconomic weakness, a highly leveraged balance sheet and integration risks remain potential headwinds for BLKB.

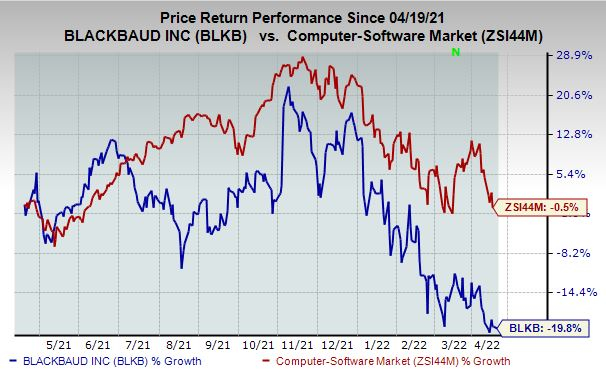

Shares of BLKB have dropped 19.8% in the past year compared with the industry’s fall of 0.5%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Blackbaud currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader technology space include Bel Fuse BELFB, American Software AMSWA and Iridium Communications IRDM. While Bel Fuse sports a Zacks Rank of 1 (Strong Buy), American Software and Iridium carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bel Fuse has a projected earnings growth rate of 3.65% for 2023. The Zacks Consensus Estimate for Bel Fuse’s 2023 earnings has remained unchanged in the past 30 days.

Bel Fuse’s first-quarter 2022 earnings per share are estimated at 22 cents, suggesting year-over-year growth of 195.65%. Shares of BELFB have dropped 8.8% in the past year.

American Software has a projected earnings growth rate of 24.24% for fiscal 2022. The Zacks Consensus Estimate for American Software’s fiscal 2022 earnings has been revised upward by 4 cents in the past 60 days.

American Software’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 92.14%. Shares of AMSWA have declined 7.2% in the past year.

Iridium has a projected earnings growth rate of 157.14% for 2022. The Zacks Consensus Estimate for Iridium’s 2022 earnings has been revised upward by 2 cents in the past 60 days.

Iridium’s earnings beat the Zacks Consensus Estimate in two of the last four quarters and met the same twice, the average surprise being 39.4%. Shares of IRDM have rallied 3.2% in the past year.

Source: Nasdaq