ESG Book Launches Corporate ESG Dashboard

|

Listen to this story:

|

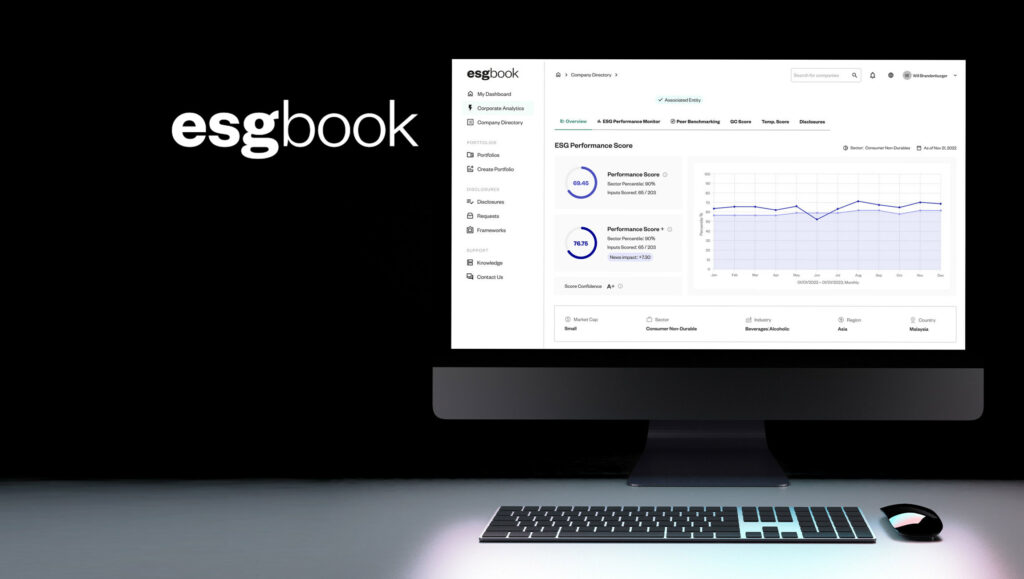

Covering 140,000+ disclosures, new dashboard combines ESG and climate data, benchmarking analytics, and reporting tools that impact performance on ESG Book’s platform.

- Companies face increasingly complex challenges around ESG data management and disclosure, as stakeholders demand greater responsiveness on sustainability issues.

- Research shows that public companies spend up to $500,000 a year on sustainability ratings to meet investor demand, yet are often dissatisfied with the results.

- Corporate ESG Dashboard delivers high quality, timely, and transparent insights to provide clients with a competitive edge in sustainability management and disclosure.

- New tool enables companies to identify financially material performance drivers, benchmark metrics against peers, and access source data for complete transparency.

ESG Book, a global leader in sustainability data and technology, announced the launch of the Corporate ESG Dashboard, a unique and transparent solution for companies to navigate strategic sustainability challenges. Covering over 140,000 disclosures, the new SaaS- based tool combines in-depth ESG and climate data, peer benchmarking analytics, and reporting features that directly impact corporate sustainability performance on ESG Book’s platform.

Companies face increasingly complex challenges around ESG data management and disclosure, with investors, regulators, and other stakeholders demanding ever greater corporate responsiveness on ESG issues.

Amid rising investor and regulatory scrutiny over corporate ESG performance, companies are encountering growing costs to procure and analyse the necessary data, despite many being dissatisfied with the accuracy and transparency of ESG ratings, and their ability to affect them.

To help companies meet these challenges, ESG Book’s Corporate ESG Dashboard combines granular data, analytics and disclosure assets to provide corporates with a one-stop performance assessment and reporting tool. The platform solution empowers companies to effectively manage, evaluate, and enhance their sustainability performance and reporting, with over 450 ESG metrics per company meticulously sourced, verified, and updated daily.

See related article: ESG Book’s Corporate Sustainability and Climate Data Made Available on Bloomberg Terminal

ESG Book’s new tool also allows stakeholders including investors, banks, and consultants to analyse corporate sustainability performance in granular detail to better identify non-financial risks and opportunities.

- Through the Corporate ESG Dashboard, users are able to:

- Analyse and optimise corporate ESG performance.

- Gain transparency around ESG performance by drilling down scores to underlying source data.

- Benchmark ESG performance against industry peers.

- Navigate reporting requirements with the world’s largest policy and regulation database.

- Disclose, validate, and update corporate ESG data in real-time, directly to stakeholders.

Dr Daniel Klier, CEO of ESG Book, said: “Companies today face the challenge of integrating ESG factors into their business strategy and decision-making processes, whilst ensuring data accuracy and effective communication. However, with ESG ratings often based on opaque and inconsistent information, corporates increasingly require a better approach to ESG data in order to meet stakeholder demands and navigate ever more complex regulation.”

“With the Corporate ESG Dashboard, companies have a powerful new tool at their disposal to take ownership of their ESG data, and transform how they manage and report on sustainability issues.”

The launch of the new dashboard coincides with research from consulting firm ERM showing that public companies spend up to $480,000 on ratings-related costs per year. Based on ERM’s survey of 104 companies, almost a third said they had a ‘low’ to ‘very low’ confidence that ratings accurately reflected their ESG performance, with common criticisms including transparency of ESG ratings, as well as a company’s ability to correct errors.

ESG Book offers a wide range of sustainability related data, scoring, and technology products that are used by many of the world’s largest investors, financial institutions, and corporates. Its SaaS data management and disclosure platform enables companies to own their own data and disclose directly to stakeholders in real-time against multiple frameworks.