S&P Global Ratings Updates SPO Approach to Provide More Transparency for Sustainable Bond Market

|

Listen to this story:

|

- S&P Global Ratings has updated its analytical approach for use of proceeds Second Party Opinions (SPOs) to provide more transparency to investors in the sustainable bond market.

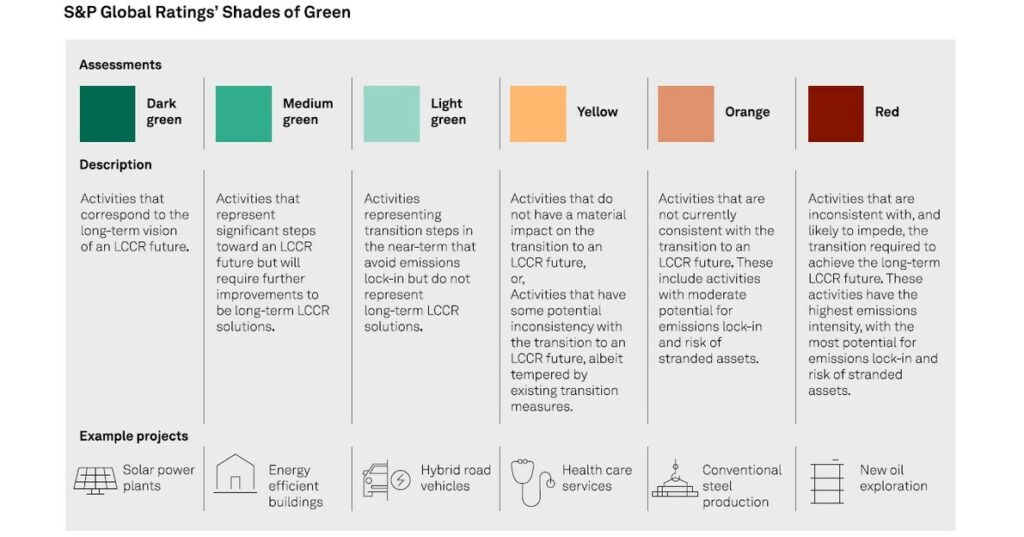

- The updated approach combines important features of the methodologies of S&P Global Ratings and Shades of Green, a science-based assessment of sustainable finance projects.

- The integrated analysis produces four analytical outputs: alignment assessment, Shade of green, issuer sustainability context, and EU Taxonomy assessment.

S&P Global Ratings has updated its analytical approach for use of proceeds Second Party Opinions (SPOs) following its December 2022 acquisition of Shades of Green from the CICERO climate research foundation. The updated approach combines important features of the methodologies of S&P Global Ratings and Shades of Green, providing additional transparency to investors that seek to understand and act upon potential contribution to a sustainable future.

Lynn Maxwell, Chief Commercial Officer at S&P Global Ratings, comments: “The launch of our revised analytical approach for SPOs, combining the best of S&P Global Ratings and Shades of Green, is an important step as we strive to provide transparency to the growing sustainable bond market, which is expected to reach $900 billion-$1 trillion this year. S&P Global Ratings’ SPOs provide customers and the wider market the benefits of a rigorous, transparent, science-based approach that includes an instantly comprehensible Shades of Green assessment.”

Related Article: Tesla Returns to S&P 500 ESG Index after Adding More Environmental Disclosures

In the updated analytical approach, S&P Global Ratings outlines its process for providing SPOs, defines an S&P Global Ratings Shade of Green and explains how it is assigned to environmental projects. In addition, it contextualizes how a sustainable finance project contributes to addressing what we consider to be the issuer’s most material sustainability factors, as well as its management of additional considerations relevant to the sustainable financing. The integrated analysis produces four analytical outputs:

- Alignment assessment: examines whether a financing’s documentation aligns with certain third-party published sustainable finance principles and guidelines identified by the issuer;

- Shade of green: for green projects, opines on how consistent an economic activity or financial investment is with a low-carbon, climate resilient future;

- Issuer sustainability context: opines on how the financing contributes to addressing what S&P Global Ratings considers to be the issuer’s most material sustainability factors;

- EU Taxonomy assessment: provides an assessment of a financing’s alignment with the EU taxonomy, upon request from an issuer.

SPOs are independent assessments of a company’s financing or framework’s alignment with market standards and are typically provided before any borrowing is raised. They are not credit ratings, do not consider credit quality, and do not factor into S&P Global Ratings’ credit ratings.