Charityvest Adds Low Fee ETF Investments to Donor-Advised Funds

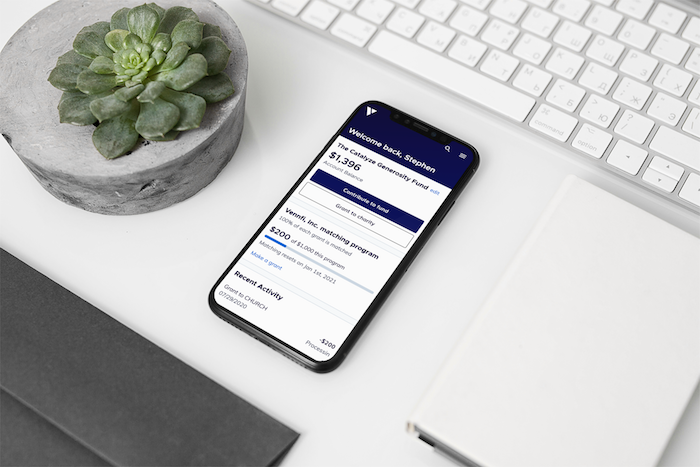

Charityvest, a modern provider of tax-deductible charitable giving accounts known as donor-advised funds (DAFs), announced the introduction of new low-fee investment capabilities. The new investment capabilities will enable donors in their community to invest their charitable balances across efficient robo-advised portfolios featuring ETFs from Vanguard and Blackrock.

In conjunction with the new investment capabilities, Charityvest announced an additional $2.2 million in seed round financing. The additional financing brings Charityvest’s total capital raised to $5.9 million and will be used for mobile app development, community giving features, initial support for advisors, and accelerating partnerships for growth. Investors in this extension round include Rick Jackson, CEO of Jackson Healthcare, DURO VC, and Ba Minuzzi, CEO of UMANA Family Office.

Donor-advised funds have become increasingly popular in recent years, as they provide an efficient way to plan for and manage charitable giving. Charityvest makes it simple to open and start using a DAF. Users can make tax-deductible contributions of cash, stock, or cryptocurrency into their fund, and direct funds to over 1.4M nonprofits in the US, while keeping their giving on a single consolidated tax receipt. With the introduction of Charityvest’s new low-fee portfolios, users can invest their remaining balance for tax-free growth to give more to charity over their lifetime, with all-in fees 50% lower than the leading provider in the DAF space.

“I started this company out of a conviction that more technology was needed to help people give purposefully in ways that integrate well with their lives. Today we are delivering donor-advised funds, a traditionally complex tool, in more delightful ways with lower fees, and we are excited about the capabilities we can build on top of our strong technical foundation from here,” said Stephen Kump, CEO of Charityvest. “I’m thrilled our investors share our beliefs, and with the new seed funding, coupled with the new investment options, we are excited for what the future holds.”

See related article: AssetMark Launches Values-Driven Investment Program, Announces Inaugural ESG Report

With investments, Charityvest allows users to set money aside in a tax-deductible account and grow the money tax-free. They can support charities at any time. Users can even give appreciated assets like business interests before a windfall to create a personal “foundation.” Having sponsored over $50M in charitable contributions, Charityvest has seen steady growth since its inception.

Traditionally, donor-advised funds have been complex and high-fee focused on serving the high-net-worth donor. Over the past year, Charityvest has focused on increasing simplicity to expand DAFs to new audiences while also lowering fees for both new and traditional users. With this new investment capability, Charityvest now offers an industry-low administrative fee among full-featured DAFs. Donors can choose from a set of efficient ETF portfolios, including an ESG option. Overall, the total cost of Charityvest is less than half of the most comparable full-featured DAF, and support for uninvested Charityvest DAFs will continue to be totally free. By coupling intuitive design with modern financial technology, Charityvest is influencing the future of how Americans give.

“We use Charityvest for our family’s Donor Advised Fund, and they are incredibly helpful for our year end planning. The fact they allow cash, stock or crypto donations, and the easy to use, intuitive platform system makes the entire process – from setting up the account to donating to our causes – simple,” said Aaron Myers, Director of eCommerce at The Blue Door Boutique.

Charityvest intends to further grow the capabilities of its donor-advised fund technology, help donors collaborate within impact-focused communities, and deliver donor advisory capabilities among others. Ultimately, with lower fees and more options for individuals Charityvest endeavors to make giving accounts as mainstream as retirement accounts.

“Our ultimate vision is for charitable giving’s share of GDP to increase by providing individuals with giving tools and services that were not previously available to them,” said Ashby Foltz, COO. “We aim to remove many of the cumbersome and uninspiring elements of giving, allowing people to focus on purposeful generosity so that their giving can write a meaningful story about impact over time.”

Source: Charityvest