Extantia Capital Launches €300 Million Platform To Accelerate Decarbonization

- The climate-first venture firm has initiated two new investment funds and a sustainability knowledge hub

- Extantia’s existing portfolio companies includeH2PRo, INERATEC, GA Drilling, BeZero and Reverion

- “We provide economically and ecologically viable investment alternatives to asset managers; education and knowledge to industry leaders and policymakers; and capital and domain expertise to entrepreneurs.”

Extantia announces two investment funds along with a sustainability knowledge hub for investors, scientists, and industry experts

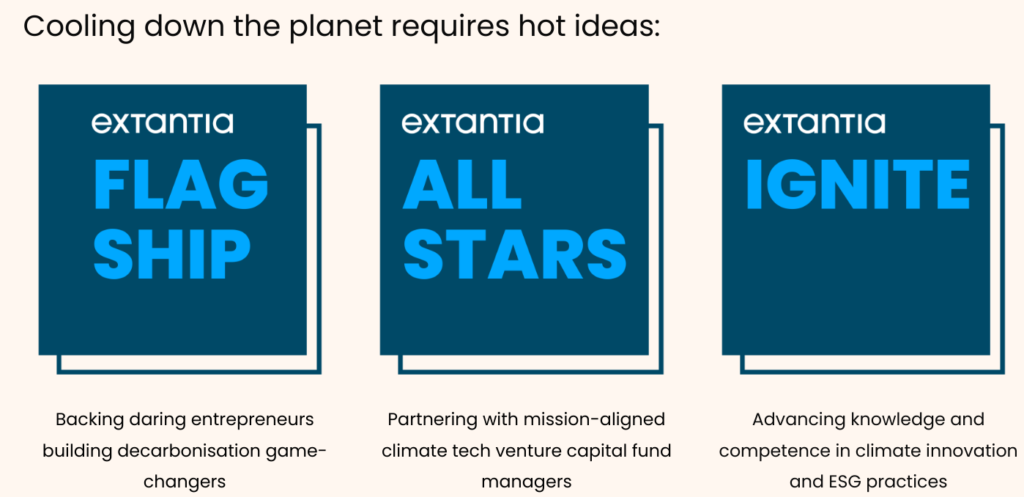

Extantia Capital, a climate-first venture firm, has announced a €300M platform to invest in and accelerate climate tech innovation. The platform includes Extantia Flagship, a €150M venture fund dedicated to backing scalable deep decarbonization tech companies, Extantia Allstars, a €150M fund-of-funds investing in climate tech venture capital funds across the globe, and Extantia Ignite, a sustainability hub advancing knowledge and competence in climate innovation and ESG practices.

With 12 direct investments and 7 venture capital fund commitments, Extantia already has over €100M assets under management and is the first climate tech venture firm in Europe to combine both investment approaches. Extantia is backed by investors such as Anglo American, Toyota Ventures and top-tier family offices such as the Piëch and Oldendorff families. Notable portfolio companies include H2PRo, INERATEC, GA Drilling, BeZero and Reverion.

“This is more than just another climate tech fund,” said Sebastian Heitmann, Partner at Extantia. “To reach net zero, we need a major change across the entire economy and mobilization of all market players. Over the past two years, we built a platform to catalyze this movement. We provide economically and ecologically viable investment alternatives to asset managers; education and knowledge to industry leaders and policymakers; and capital and domain expertise to entrepreneurs.”

See related article: Machine learning-led decarbonisation platform Ecolibrium launches in the UK

Image source: Extantia Capital

To ensure its investments have a significant and timely impact, Extantia conducts a rigorous Carbon Math assessment prior to any engagement and is integrating impact achievement goals into the fund manager’s compensation. Areas of primary interest are energy, industrial processes, buildings, transportation, and carbon removal technologies. Examples include sustainable fuels and petrochemicals, hydrogen supply chain, renewable baseload power, and direct air capture. Extantia also uses comprehensive methodology to verify that new technologies “do no harm” and avoid negative impacts on the environment and society.

Behind Extantia’s impact calculations and ESG practices is Extantia Ignite. The sustainability hub brings together scientists, ESG and sustainability experts to create transparency and science-based guidelines for the climate innovation ecosystem. Among others, the hub creates tools for Extantia’s investment team to evaluate and report climate impact; helps portfolio companies implement ESG best practices; and provides actionable insights to investors.

“Extantia Ignite is where industry meets technology and science,” said Dr. Laura-Marie Toepfer, Partner at Extantia. “By combining our scientific carbon measurement with sustainable investing, our hub is designed to engage and empower all stakeholders — entrepreneurs, policymakers, family business leaders, and institutional investors — to achieve their own net zero targets and that of their customers. We regularly publish our work to advance thought leadership and foster public discussion.”